📈 Data to start your week

$1 trillion boom ↑ GLP-1s eat pharma ↑ China carbon ↓

Hi all,

Here’s your Monday round-up of data driving conversations this week in less than 250 words.

Let’s go!

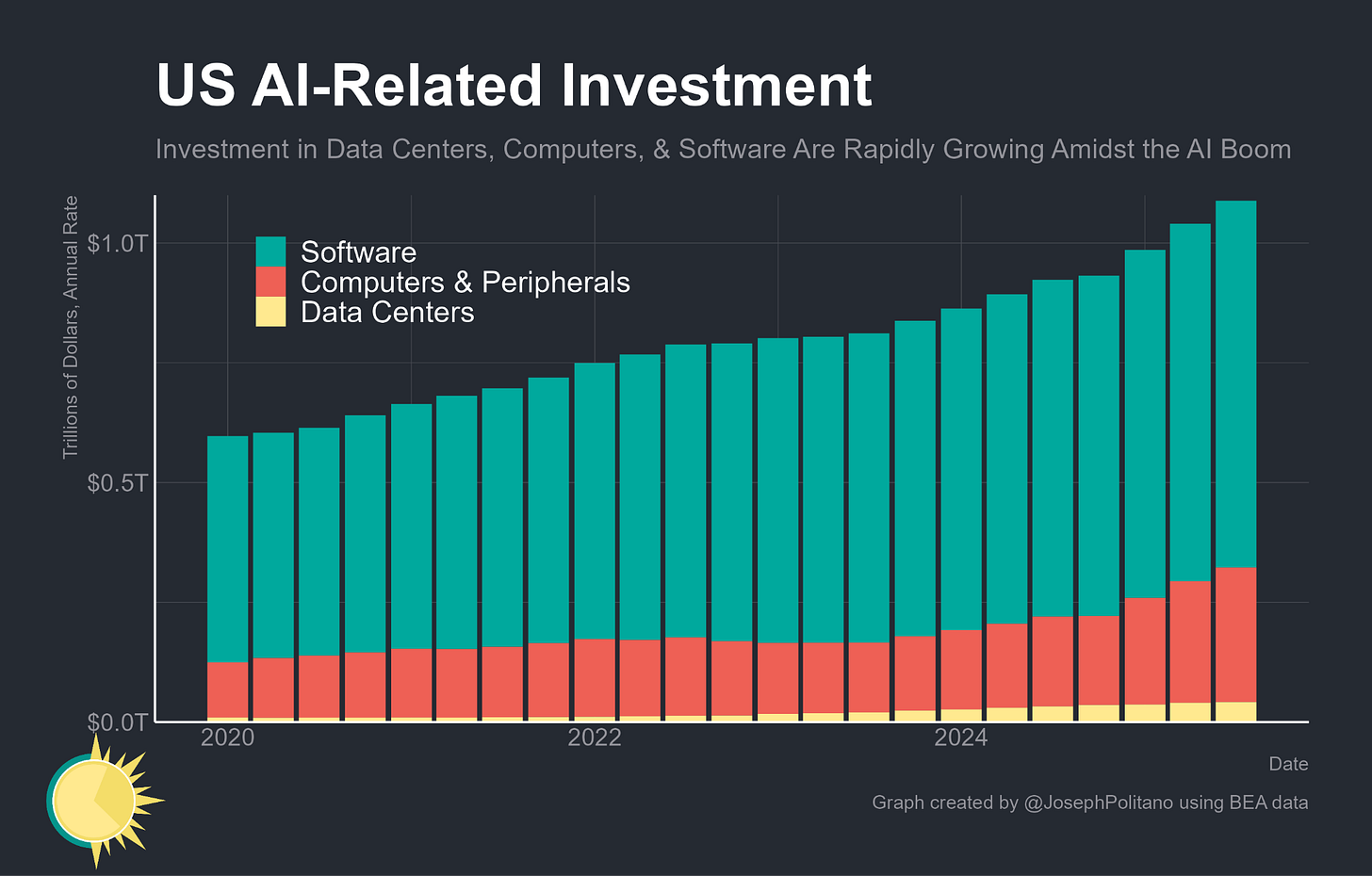

AI boom ↑ US data center and software investment now exceeds $1 trillion annualized (3.5% of GDP).1 See our analysis.

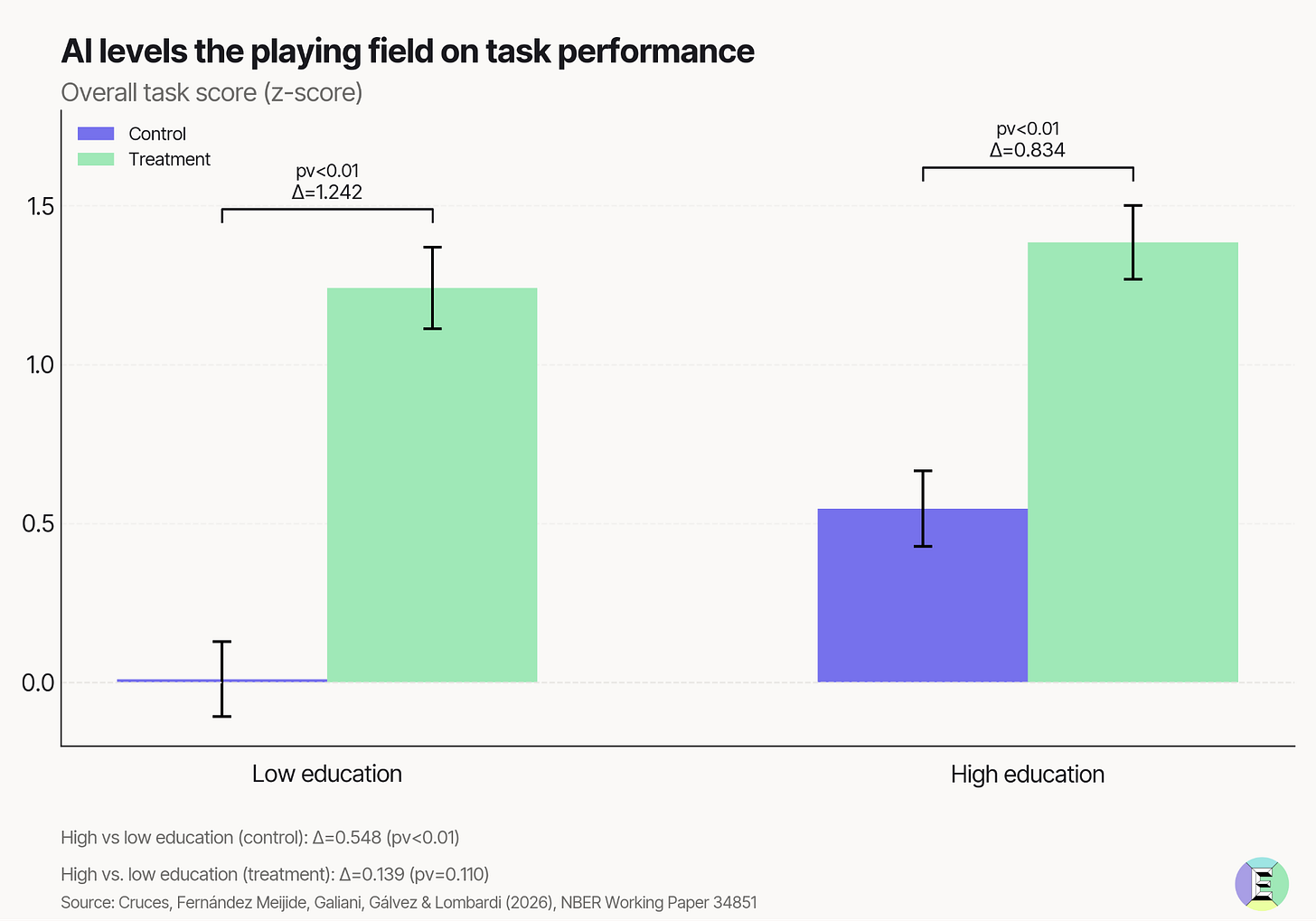

Prompt assist ↑ On a realistic business task, AI cut the performance gap between less‑ and more-educated adults by three-quarters.

Appetite for profit ↑ The global GLP-1 drug market is set to make up almost 16% of the global pharmaceutical market by 2030, at ~$268 billion.

Grid hunger ↑ IEA forecasts global electricity demand through 2030 to grow 50% faster than the past decade, as consumption from industry, electric vehicles, air conditioning and data centers increases.

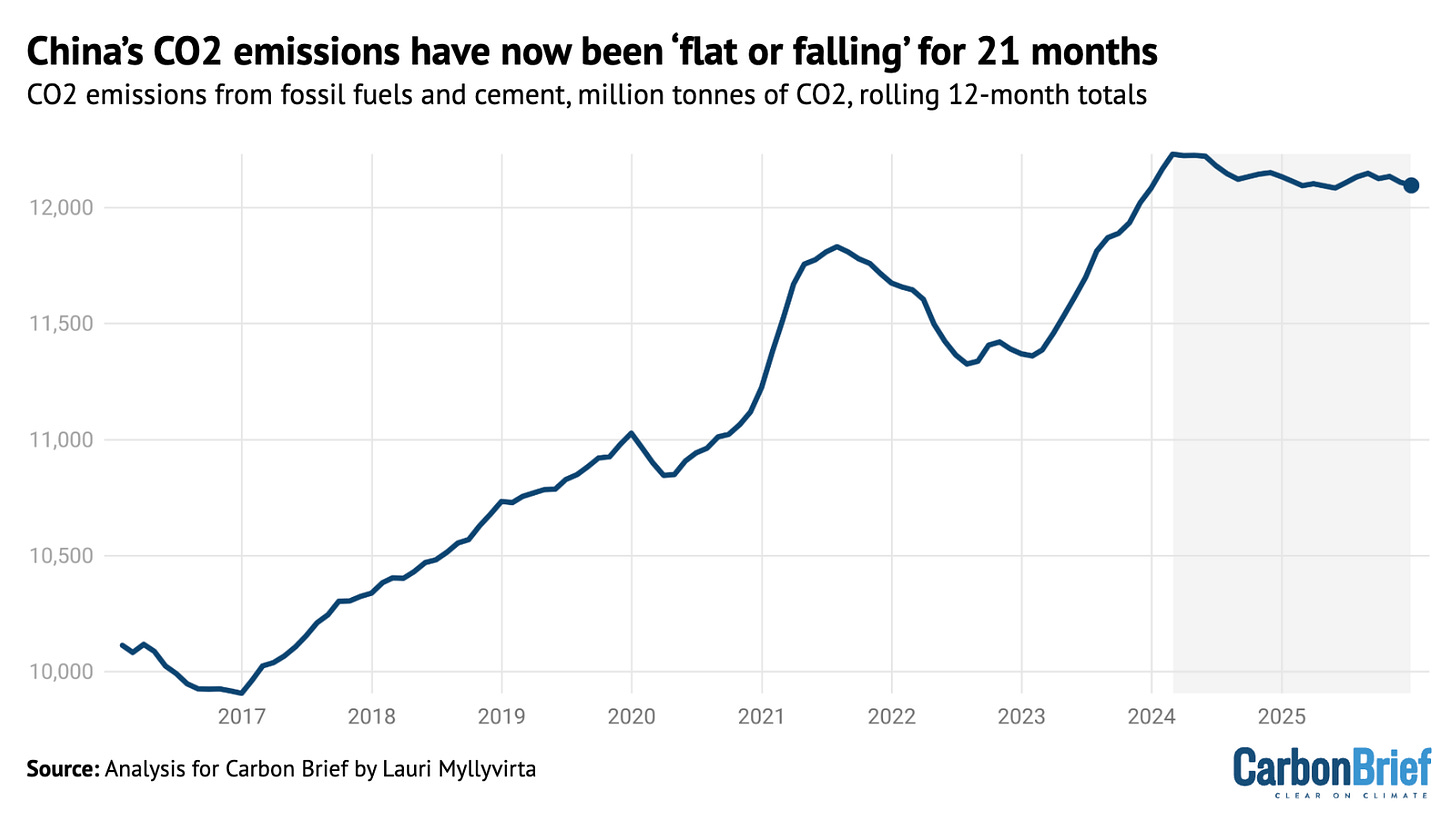

Peak China carbon ↓ China’s CO2 emissions fell 0.3% in 2025 – flat or falling for 21 straight months.

Can’t beat the sun ↑ More than 99% of all new US electricity generating capacity in 2026 will be solar, wind and storage, equivalent to adding 70 nuclear plants.

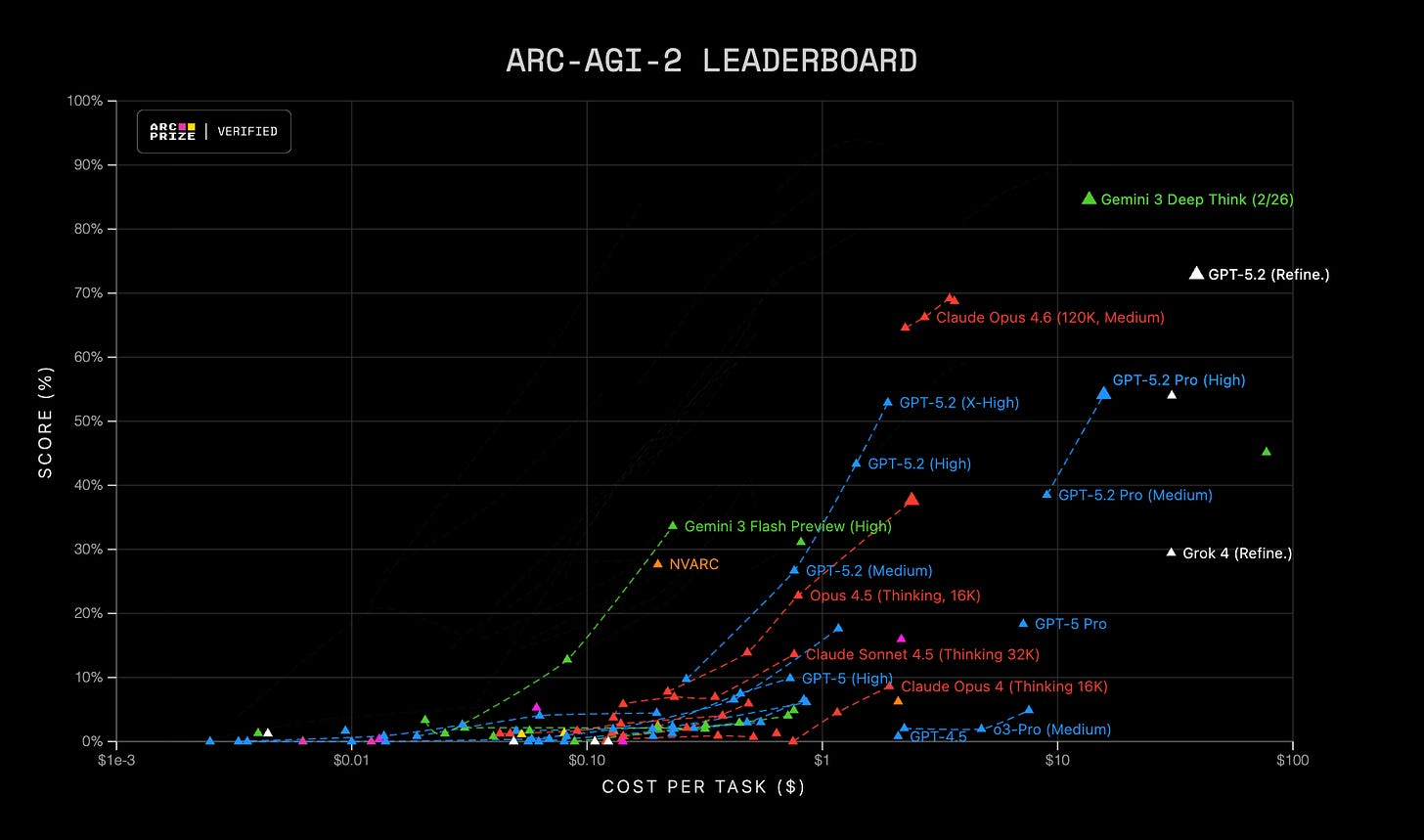

The reasoning jump ↑ Gemini 3 Deep Think scored a record 84.6% on ARC-AGI-2.2 ARC-AGI-3 drops in March.

Europe’s AI alternative ↑ Mistral shot over $400 million annualized revenue, up more than 20x in the last year.

Generation AI ↑ People between 16 and 24 years old in the EU are twice as likely to use generative AI (64%) as the general population (32.7%).

Today’s edition is brought to you by Polymarket

Who has the best AI model by the end of February?

*Disclaimer: Polymarket is a real‑money prediction market. Trading involves risk and may not be available in all jurisdictions. Nothing here is investment, tax, or legal advice. Please check your local regulations and only stake what you can afford to lose.

Thanks for reading!

The multi‑hundred‑billion capital expenditure plans reported by big tech firms are global capex numbers that also include other assets (such as warehouses, logistics infrastructure, operating costs and non‑data‑center facilities that aren't included in the buckets above), and so they cannot be directly compared to the US‑only fixed‑investment values in the graph here.

ARC-AGI benchmarks test how well AI can solve novel reasoning puzzles that humans generally have no issue with.

The $1T annual AI investment number caught me - that's staggering scale for infrastructure that mostly doesn't exist yet.

I've been tracking who's actually winning in the agent space vs who's getting funded. The gap is massive. Most investment goes to infrastructure plays (models, chips) while the operational value compounds at the application layer.

Wrote about the Feb 2026 data: https://thoughts.jock.pl/p/ai-agent-landscape-feb-2026-data

The educational performance gap stat (75% reduction via AI) is interesting but feels optimistic. What's the implementation complexity? Most gains require operational changes, not just AI access.

The petrostates have yet to face up to the electrotech demand & supply transition (solar, wind, nuclear, batteries, EVs, heat pumps, HVDC grids,...), which is just getting underway. Our grids lag far behind what's needed now, let alone what's coming. Canada and US are ill-prepared now, with little evidence of intent, beyond empty words, to accelerate progress.

By contrast, China's electricity demand grows by about one 'Germany' per year. They build 2 Germanys of clean electricity to stay well ahead of demand, thus keeping power costs low while reducing CO2.

Chinese coal plants are paid to stand by in reserve in case they are needed, so despite building more thermal plants, actual coal consumption is dropping. Thermal plant utilization is already only 40%.

China is exporting electrotech demand and supply to the global south at low interest rates, while Canada and US are focused on LNG, coal, and oil.