🔥 Can OpenAI reach $100 billion in revenue by 2027?

Sam Altman's claim sounds insane. But math says otherwise.

Sam Altman says OpenAI will do “well more than $13 billion” in sales this year1. Moreover, he suggested that the company might reach $100 billion in revenues by 2027. If one were to consult my thesaurus for a word to describe this latter claim, one might end up with one of these to describe it:

Outlandish, ludicrous, farcical, nonsensical, cockamamie, balderdash, harebrained, risible, inane, asinine, patent lunacy, utter madness, sheer insanity.

But I don’t pretend to know it all, so let’s figure out whether that $100 billion claim is feasible. Today, for members of Exponential View, we work backwards to understand how realistic Sam’s expectations are AND where the money could come from.

Working backwards: The math of momentum

The beauty—and terror—of any subscription business is forward momentum. Unlike shrink-wrap software, where customers buy once and then disappear, subscription customers stick around. They pay month after month and year after year if you’re worth it. This is one reason why the software-as-a-service model is so popular. There is attrition when customers stop paying, but it’s never 100% of them in a single month. Churn rates might be 3-5% monthly, but these get compensated by new customers in a healthy subscription business.

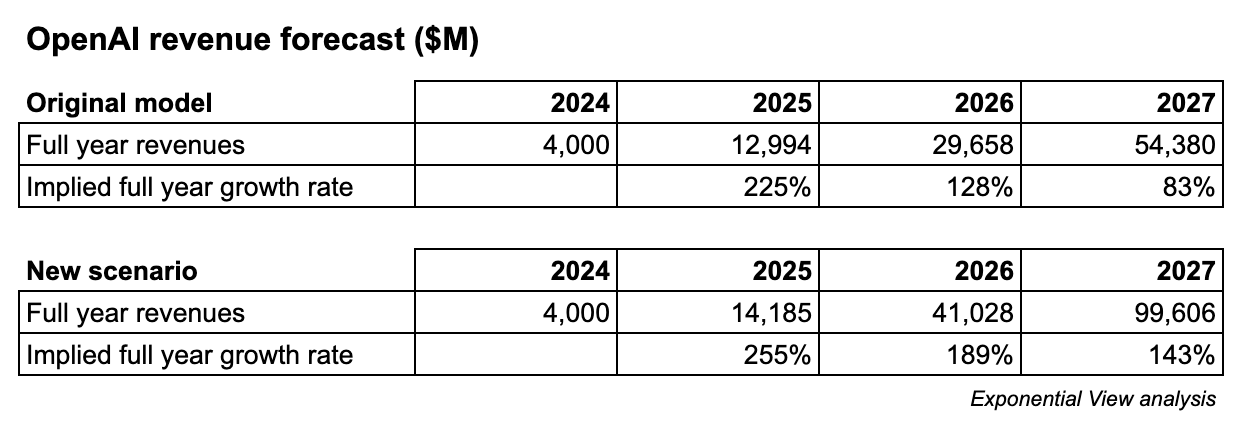

The nature of the subscription business that OpenAI runs will help us make better assessments on where the firm’s revenue trajectory will go. Exponential View’s current model for OpenAI had it nudging $13 billion in revenue by the end of 2025. We knew from our modelling and various leaks that the first half of the year’s revenue totalled $4.3 billion.

This suggested that the second half of the year would be even more lucrative, at around $8 billion. Before Sam’s claim, we estimated December 2025’s revenues at $1.8 billion per month, at an annualized run rate of just shy of $22 billion.

So our previous 2025 view was this: $13 billion in sales for the year, but a rapid growth rate with December showing an annualized rate some 70% higher.

Now, if we take the assumption that the firm will turn in “much more than $13 billion” this year, we reckon that $14 billion is the smallest number that could qualify as “much more than”. That “small” adjustment fundamentally changes the growth equation. To achieve $14 billion in annual revenue, December’s numbers need to weigh in at $2.1 billion, an annualized run rate closer to $25.7 billion than the previous $22 billion.

It also shows that OpenAI’s growth rate is decelerating more slowly than our mid-case scenario for our model; in other words, the firm is maintaining its revenue growth better than we initially expected. Compounding growth has that kind of effect.

As a subscription business, they take that monthly momentum into 2026, which changes the firm’s 2026 revenues. Entering next year at a $25.7 billion annualized run rate, OpenAI would exit the year at no lower than $25.7 billion, even if it manages to do nothing more than tread water and cover churn.

That notion of going from more than doubling in 2025 to zero expansion in 2026 is preposterous. That just doesn’t make sense for subscription businesses or for businesses with the kind of momentum OpenAI has.

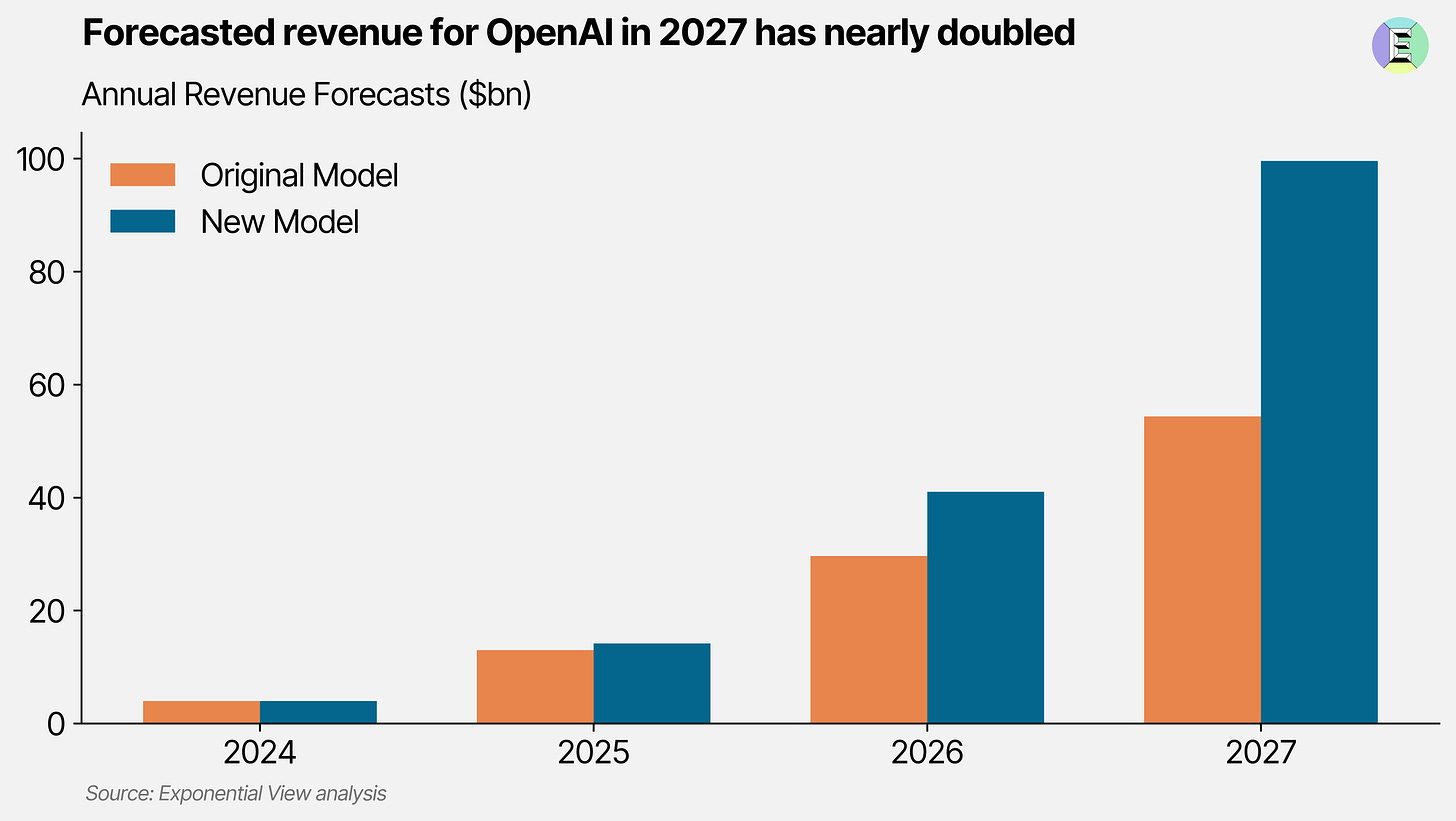

But if their annual growth rate is roughly a quarter lower in 2026 than the previous year, those gains still add up. The firm could close the year on $41 billion in revenues and exit revenues of $58 billion annualized. This is well above the $29 billion mooted for its 2026 revenues by various leaks. Compounding adds up.

Working through the scenario, we put Sam’s suggestion of $100 billion within shouting distance. Assuming a slowing growth rate in 2027, the firm could still reach this milestone. To get there, we’ve made the heroic assumption that 2026’s growth rate is roughly three-quarters of that of 2025, while decelerating at a similar-ish rate in 2027.

This isn’t pure guesswork; it’s constrained by the “physics” of subscription models. Revenue can’t jump around wildly month-to-month at this scale. It layers on. And the law of large numbers means that revenue growth ultimately slows, but equally, it can’t fall off a cliff.

Because OpenAI’s growth rates are unprecedented, we can’t compare it to other software companies in a hypergrowth phase when their revenues exceed $4 billion per annum. There are none!

Instead, we look at proxies. Data from investor ICONIQ of fast-growing software companies, once their revenues exceed $50 million (yes, m-illion), shows that for every doubling of revenue, their growth rates tend to drop by a third to a half. In other words, we’re flying blind. Their AI companies have broken all records, so I’ve just assumed a similar slowdown in growth rates.

Traditional software companies see growth rates spike, then plateau after 1-2 years of product-market fit. However, OpenAI and Anthropic have maintained over 100% growth well into the multi-billion-dollar scale, something previously thought impossible. And in recent leaks, Anthropic has hinted that they forecast their revenues as high as $70 billion in 2028, well above their previous forecasts. Both companies seem willing to signal that demand is surprising them.

We’re not yet replacing our original model with this new scenario. But we are noting that given how AI firms have broken every record for revenue growth, this is what a path to $100 billion by 2027 might look like.

Where will $100 billion come from?

So that’s the top-down view. But ultimately, customers need to be forking over the cash. What kind of revenue mix would make $100 billion make sense?

Stream 1: Enterprise API

Modelled enterprise API revenue, 2027: $34.8 billion2

First, we know that token consumption is continuing to rise, even as prices fall. At the same time, AI continues to progress into production, with a shift in the enterprise API component of OpenAI, which made up 25% of revenues in October last year and is likely now up to around 35%.