💸 What $500bn buys you in AI (and what it doesn’t)

The bull, the bear and the disruption premium

“The level of deep insight into technological trends you share is unmatched. No one is doing it like you.” – Susan, a paying member

I was discussing the OpenAI secondary share sale with a friend. Reputable sources say the firm is allowing insiders (early investors and employees) to sell up to $10.3 billion of stock at a $500 billion valuation. Apart from being great news for San Francisco realtors, it gives outsiders a chance to get a slice of this epochal company.1

Discussing this with my buddy, he asked me a question over WhatsApp:

This isn’t a question about whether OpenAI is good or even a great company. It isn’t a question about whether it will become profitable. It isn’t even a question about whether it has peaked or not. Or whether the firm has great prospects over the coming years.

The subtext of the question is this:

Given all the other places you could put your money, would you choose OpenAI? Will its return be better than buying the Nasdaq?

Let’s work through this systematically. The Nasdaq has delivered roughly 13% annual returns over the past decade, albeit with considerable volatility. For OpenAI to justify its valuation premium, it needs to outperform this benchmark substantially.

My gut reaction was “no way”. I did the mental math of the Nasdaq return and just felt that OpenAI could never compound faster than that.

But nothing beats pencil, paper and Excel and when I sat down with my simplistic OpenAI model and ran some scenarios, a different picture started to emerge.

Today, I’m going to lay out some of that thinking here.

The bull case math

At $500 billion, OpenAI is, today, worth roughly the same as Netflix. The streamer delivered $39 billion in revenues last year and profits before tax of nearly $10 billion. That is approximately ten times the sales of OpenAI in 2024. The AI company was, of course, deep in the red that year, losing about $5 billion.

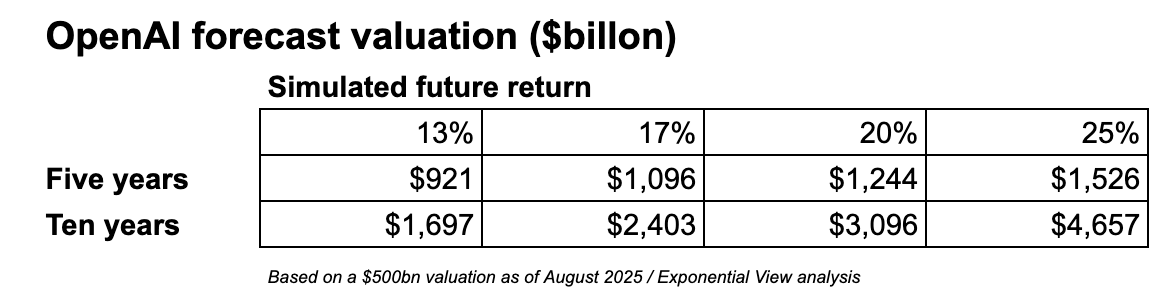

For buyers of OpenAI’s stock today to match Nasdaq’s 13% annual return over five years, OpenAI would need to reach a $900 billion valuation.

But that wouldn’t be a good deal.

OpenAI is a privately held company with a complex shareholding structure and governance relationship. It also has a commercial deal with Microsoft which provides cloud infrastructure, access to Azure’s distribution channels and billions in capital support. This all in exchange for exclusive licensing of specific technologies and 20% of OpenAI’s revenue through 2030, up to a cap of $120 billion total return.

As a private company, it doesn’t face the same financial and governance scrutiny as a public firm. In practice, private shares with complex information rights and restricted transfer often warrant a material liquidity and governance discount. Your hurdle rate should reflect that, perhaps demanding another 10-12% for those idiosyncratic risks.

All of that means you’d need to demand a risk premium – and seek a return better than that of the Nasdaq.

In any case, while Nasdaq’s returns over the last decade have averaged 13% per annum, its three-year return has been closer to an exuberant 23%. Now, I don’t think that can be sustained. But over fifteen years, the Nasdaq has returned about 17% which seems like a decent place to start.

Applying different risk premia to that 17%, an investor taking a position in OpenAI might ask for a 20% or 25% annual return, with real implications on the firm’s five-year valuation – perhaps as high as $1.5 trillion.

At $1.5 trillion, OpenAI would sit somewhere between Tesla ($1.08 trillion), Broadcom ($1.42 trillion) and Meta ($1.85 trillion). Is this plausible?