🔴 A messier AI story

Nvidia, OpenAI and the messy middle

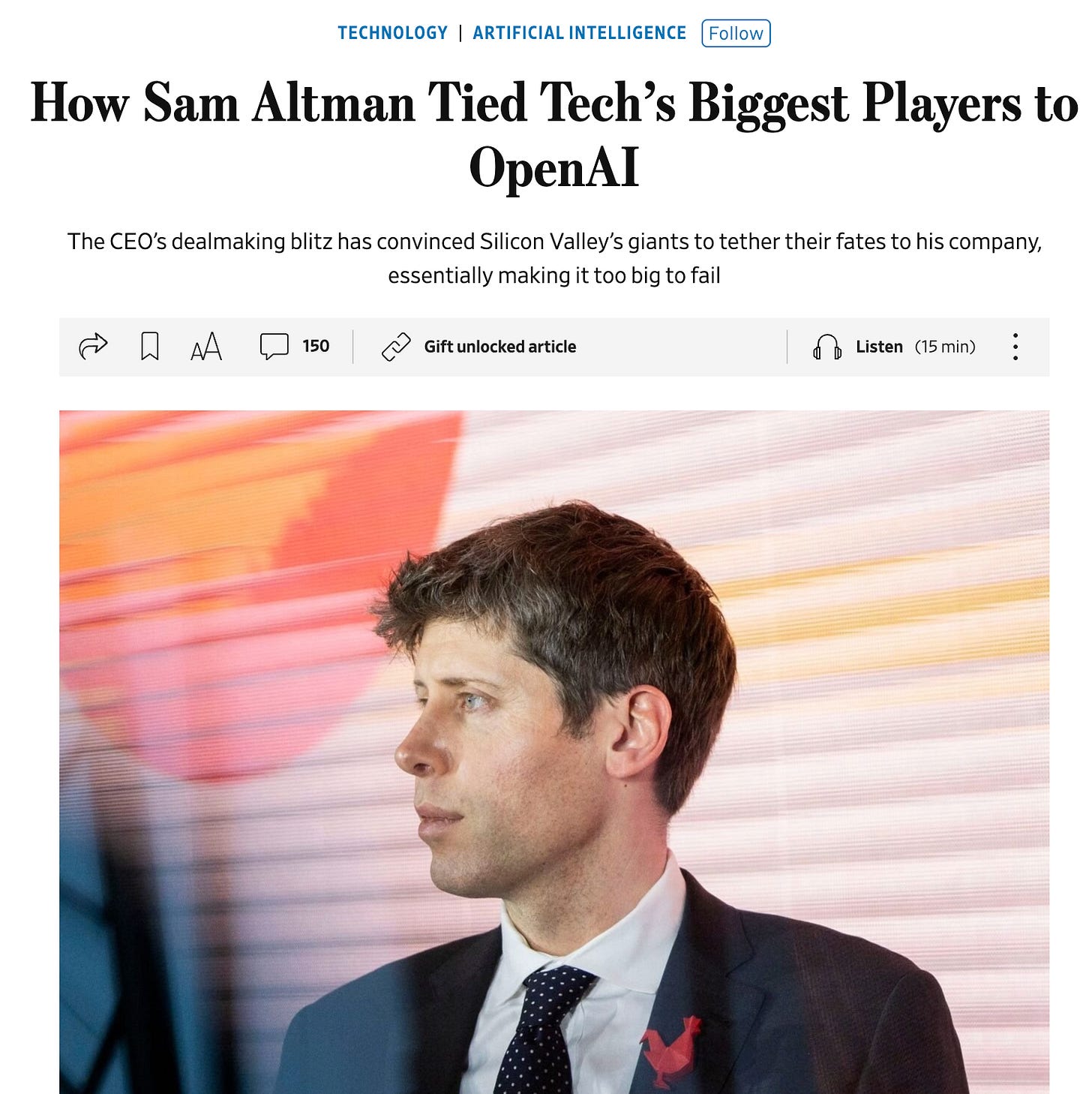

The latest WSJ report about Sam Altman’s influence on the leading tech companies got a lot of attention because it claims that Altman showed interest in using Google’s homegrown TPU chips alongside Nvidia’s GPUs.

The flirtation apparently triggered Nvidia’s boss Jensen Huang.

What matters is the financing architecture forming around OpenAI’s compute build-out. As the WSJ writes:

As part of the deal, Nvidia is also discussing guaranteeing some of the loans that OpenAI plans to take out to build its own data centers, people familiar with the matter said—a move that could saddle the chip giant with billions of dollars in debt obligations if the startup can’t pay for them. The arrangement hasn’t been previously reported.

We’ve known that OpenAI is creating a web of relationships with its suppliers beyond simple cash-for-services. This has been the firms métier since its deal with Microsoft, and while complicated and unorthodox, it can be seen as expedient in a fast-moving market.

When I reviewed that 11 days ago, I cautioned that while there weren’t real issues yet, we should be watchful of temptations to use

increasingly complex deal structures that blend credit lines, equity stakes, and multi-year purchase commitments.

Well, if the Journal’s reports are correct, we’re seeing exactly that: Nvidia discussing guarantees of OpenAI’s data-centre loans. The chip shop would practically agree to repay OpenAI’s creditors if OpenAI cannot. In other words, Nvidia is extending its balance sheet to backstop a customer’s debt.

In our framework, this would mark a deterioration in our funding quality gauge – the measure of how resilient the sector’s financing structures are. It worsens funding quality for both OpenAI and Nvidia. Worsens but overall FQ for the sector stays in low amber territory, still far from red.

Last Saturday, I made the point that booms tip towards bubbles when balance sheet gymnastics become the norm. Well, this isn’t the norm yet… but if these reports are accurate it would be another early sign of micro-level deterioration in funding quality.

The counter case

In a counter case, what else would Sam Altman do?

If you assume that artificial intelligence is the next big thing, then the last thing you’ll want to do is sit this out. Being confident in your story and momentum could lead you to doing exactly this kind of deal. Of course, being desperate could take you down the same path.