💸 The imminence of the AI bust [correct]

Not all stress signals disaster

Having to resend this as I duplicated paragraphs in the last version. Apols.

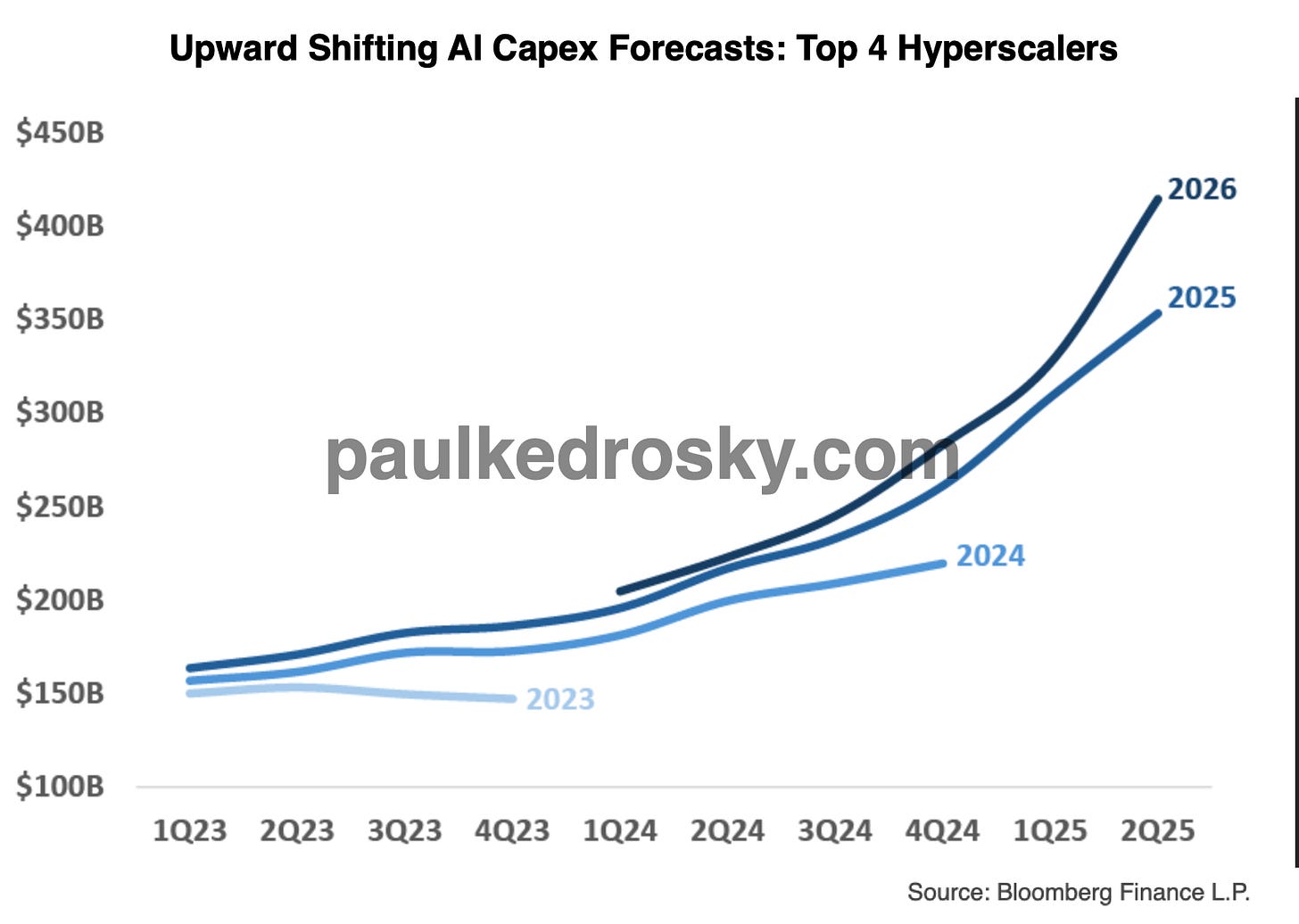

When does an AI boom tip into a bubble? Paul Kedrosky points to the Minsky moment—the inflection point when credit expansion exhausts its good projects and starts chasing bad ones, funding marginal deals with vendor financing and questionable coverage ratios. For AI infrastructure, that shift may already be underway; the telltale signs include hyperscaler capex outpacing revenue momentum and lenders sweetening terms to keep the party alive.

Paul makes a compelling case. We’ve entered speculative finance territory—arguably past the tentative stage—and recent deals will set dangerous precedents. As Paul warns, this financing will “create templates for future such transactions,” spurring rapid expansion in junk issuance and SPV proliferation among hyperscalers chasing dominance at any cost.

The pattern holds across history. Of the 21 investment booms I’ve looked at since 1790, 18 ended in a bust; funding quality drove roughly half of those collapses. Yet not all strain signals disaster—every investment requires leverage, from a mortgage to export financing. The question is whether we’re building productive capacity or inflating asset prices and shunting risk around.

For AI infrastructure, the warning signs are flashing: vendor financing proliferates, coverage ratios thin, and hyperscalers leverage balance sheets to maintain capex velocity even as revenue momentum lags. We see both sides—genuine infrastructure expansion alongside financing gymnastics that recall the 2000 telecom bust. The boom may yet prove productive, but only if revenue catches up before credit tightens. When does healthy strain become systemic risk? That’s the question we must answer before the market does.

This is why funding quality is one of the five key gauges we watch in our AI dashboard.

Consider the dot-com bubble. An investor who heeded the first warnings in early 1996 and pulled out would have forfeited extraordinary returns—four times their money—over the next three years. Sensible risk management would have preserved decent gains even for those who stayed significantly invested past the March 2000 peak. Early exit also meant misallocating capital relative to the emerging internet economy—steering clear of Amazon and the infrastructure layer that defined the next decade. The bubble was real; so was the cost of calling it too early.

Today’s AI boom presents the same dilemma. Genuine infrastructure expansion intertwines with speculative excess, and distinguishing them matters less than managing exposure across the cycle.

Hyperscaler capex may look frothy now, but infrastructure supercycles reward those who mange the volatility rather than the timing. Exit too soon and you miss the compounding gains; stay reckless and you absorb the correction.

The Credit Question

Credit expands almost inevitably during boom periods as companies proliferate and their funding requirements grow. The question isn’t whether credit is expanding—it’s whether that expansion runs ahead of the real economy’s capacity to validate it through revenue.

So we measure this through two indicators. First, industry strain: the degree to which actual customer revenues fund capex, rather than borrowed capital or vendor credits. We favor real revenues over cash flow because it allows consistent historical comparison, reaching back to 19th-century railways before modern accounting standards existed.

Second, funding quality—our fifth gauge—which assesses how unconventional the financing structures appear. Our aggregate number obscures meaningful variation: Microsoft, with forty years of profitability and fortress balance sheets, finances data center expansion through plain-vanilla bonds; CoreWeave, lacking that track record, needs to be more creative. Both deploy capital at scale, but one signals confidence in returns while the other reveals funding strain.

Where we actually stand

Most of us live our lives denominated in the tens and hundreds, occasionally, perhaps thousands. The numbers through around in this capex boom are astronomically, tens, hundreds of billions. Psychologically those numbers feel big, but they aren’t.

In absolute terms, the housing bubble burst when $1.4 trillion of mortgages lent to people with poor credit were propping up about $8 trillion of complex financial instruments.

Yet a $20bn special-purpose vehicle backed by Meta’s purchase agreement hardly compares to diversified corporate debt but it sets a template. Once one SPV proves viable, bankers replicate the structure rapidly, each iteration lowering the bar for credit quality. History warns us: five years separated the first subprime-backed derivatives from the 2008 collapse: innovation to implosion in a single cycle.

The Bank for International Settlements monitors a reliable early-warning gauge for such crises: the credit-to-GDP gap, which tracks total private-sector credit against its long-term trend. When this measure exceeds 10 percentage points, the probability of a crisis within three to five years rises sharply; below 2%, credit sits within normal bounds. In the late 1980s, as the US stumbled into the savings-and-loan crisis that marred Reagan’s second term, the gauge hovered near 10%. During the 2008 global financial crisis, it hit 12%. The question now: where does AI infrastructure financing sit on this spectrum?