🔴 Did the AI critics find their smoking gun?

Circular financing ahoy

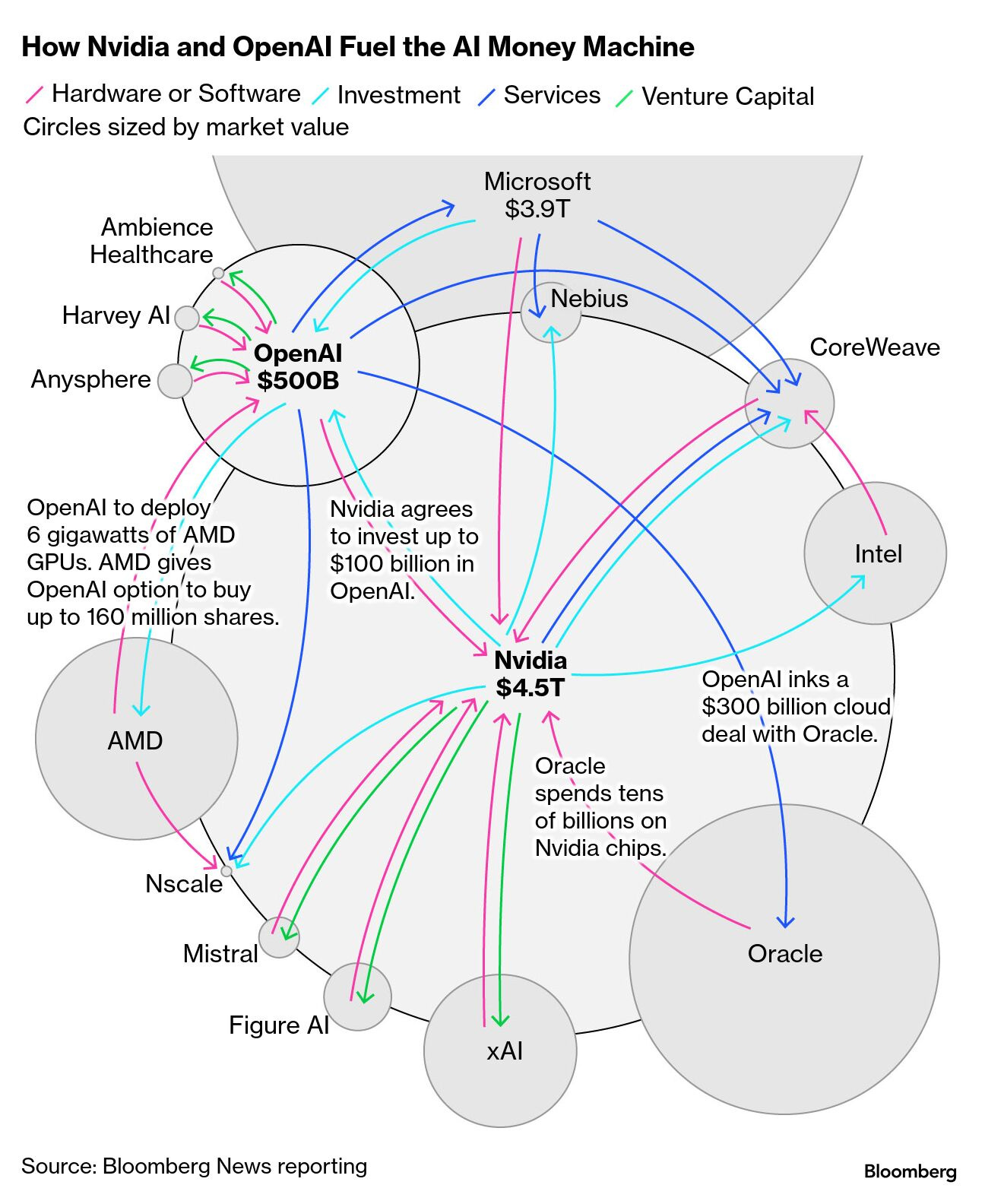

When we published our Is AI a Bubble? framework two weeks ago, one of the most frequent critiques I got rested on the “evidence” that the financing underlying the AI boom is circular and thus we’re heading to the 2000 bubble. This week, I saw more charts like this than sourdough loaves in lockdown.

These approaches are clearly creative—and at some point they could veer on problematic. It feels insalubrious to give your customers money to buy your product, doesn’t it?

The late-1990s telecoms bubble ran on a financial ouroboros. Lucent and Nortel extended billions in loans to nascent network operators, who used that borrowed capital to buy switching kit and fiber optic cables—well before they had paying customers to justify the build-out. Cheekily, the vendors immediately booked those sales as revenue. The startups reported explosive growth; the equipment suppliers hit quarterly targets; Wall Street applauded. In fact, all they had done was moving money from the financing sleeve to their …