We believe that GLP-1 drugs are one of the most important technologies of the next five years. In today’s post, we break down three scenarios of impact, focusing primarily on US society.

Obesity in America has peaked. Between 2020 and 2023, the adult obesity rate fell by about two percentage points, ending a decades-long rise. The likeliest cause is not dieting or exercise but pharmaceuticals, specifically GLP-1 drugs.

First developed in the early 2000s to treat type 2 diabetes by mimicking the action of the naturally occurring hormone glucagon-like peptide 1, GLP-1 receptor agonists have since been shown to have a positive and significant impact on obesity, other medical conditions and biological functions.

GLP-1s can lead to significant weight loss—up to 22.5% of body weight.

They reduce systemic inflammation, treating cardiovascular disease and showing potential benefits for neurodegenerative and other diseases.

Patients on GLP-1s and retrospective studies report relief from anxiety and intrusive thoughts.

There’s a reported 40-50% reduction of opioid and alcohol intoxication in people with a history of related disorders and there are phase 2 trials showing reductions in alcohol use and opioid cravings.

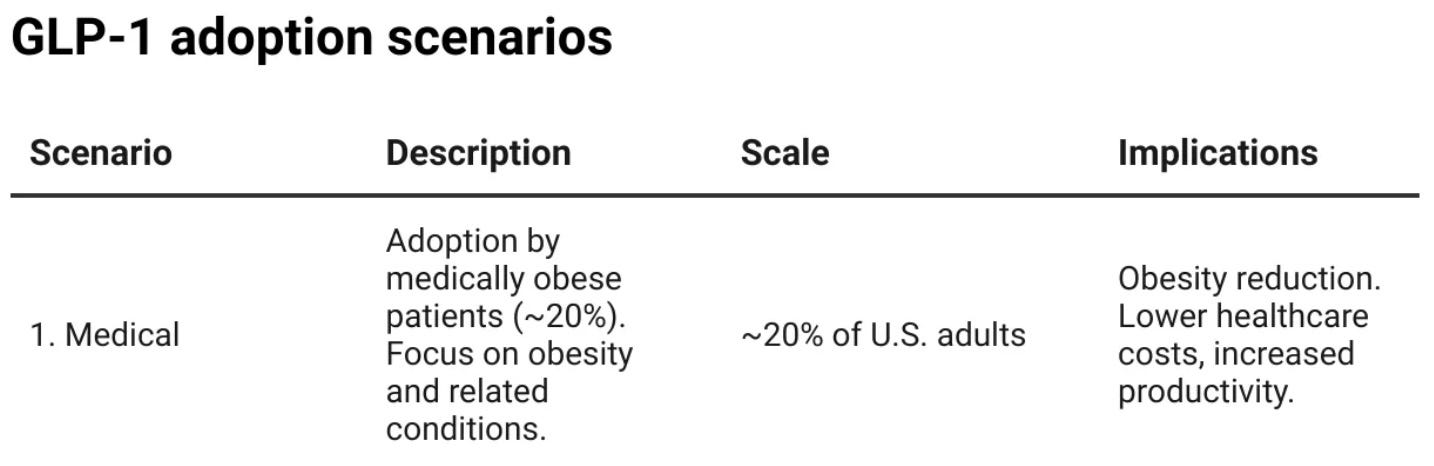

We believe GLP-1 drugs will be one of the most impactful technologies in the US over the next five years (as we argued in our previous essay on GLP-1s). When used for medical purposes alone, they could affect 20% of US adults — 50 million people. But they’ll go much further. Today, we’ll lay out three scenarios we foresee could take place depending on regulation, R&D and societal acceptance. These three scenarios are:

Medical

Lifestyle enhancement

Everyone, everywhere

Regardless of the scale of adoption, the impact of GLP-1 drugs will be significant. Today we’ll go into each level of impact.

Before we go further, we’d like to thank EV members Vishal Gulati and

for early feedback on this piece.Scenario 1: Medical

In Scenario 1, GLP-1s are primarily used to treat obesity, weight loss and other medical conditions, as regulated by the FDA. But even with this ‘limited’ use, their impact will be significant. They can help alleviate the burden of modern-day conditions, reduce illnesses and mortality in work-age populations and affect a range of preventable conditions. GLP-1 research has diversified to include non-alcoholic fatty liver disease, weight loss to help with polycystic ovary syndrome, cardiovascular health, Alzheimer’s, arthritis and sleep apnea.

In this first scenario, we ballpark the adoption in the US to be around 20% of the adult population in the next five years. We estimate that roughly half of people affected by obesity in the US will be eligible to benefit from GLP-1s — overall, around 50 million people.

And while we don’t want to measure humans only through productivity, getting almost 50 million people back on a healthier footing will be significant for the economy. We estimate that this could lead to a cost saving of 1.4% of GDP or over $400 billion annually.1 The UK government is already talking about GLP-1s as one of the key ways to reduce the burden on the NHS and increase productivity as they create a reform plan for the future of the nation’s healthcare.

However, the total impact could be much larger. We’ve focused only on obesity adoption due to the certainty of its impact, but trials are showing promise in other areas. For instance, GLP-1s could help the US opioid crisis, which costs $1.5 trillion a year – the cost of many people dying young or living with serious consequences.

Now, what could come in the way of Scenario 1? A 30-day supply of Wegovy in the US costs over $900 without insurance. This is over $540 billion a year if all eligible individuals used it—around 12% of total US healthcare expenditure. Figuring out who will pay for this is the challenge. FDA approvals are increasing Medicare coverage, but it is still a long way from covering all recipients with obesity. Broader adoption in the US would require either greater insurance coverage or price reductions to match international levels ($169 in Japan, $93 in the UK, and $87 in Australia for a 30-day supply). There is every reason to believe that this will happen. Many new GLP-1 drugs are in development pipelines. When these come to market, prices will fall quickly. Moreover, semaglutide2 is going generic in Canada, India and China in 2026, so brace for international adoption and black market export rings.

Another hurdle is scientific. There is a chance that some people taking GLP-1s are worse off. An estimated 20% of obese patients have minimal or no response to GLP-1s and around 40% stop treatment after 12 months – mostly due to shortages, dosage inconvenience3 and costs. This often results in patients regaining weight but with significantly less muscle mass (25-40% depending on the treatment). The industry is developing new treatments to counteract this. Expanding our knowledge of side effects is a crucial requirement if these drugs are going to expand beyond medical usage.