📊 EV’s Charts of the Week #95

Hollywood, ESG alphabet, stocks & bonds, Starlink++

Hi, I’m Azeem Azhar. I convene Exponential View to help us understand how our societies and political economy will change under the force of rapidly accelerating technologies. Every Wednesday, I do this in Charts of the Week.

CHART OF THE WEEK

The blockbuster era

We can’t depend on the movie business, such as it is, to take care of cinema1.

In a brilliant series of blog posts, James McMahon shows that industrial Hollywood is on a mission to reduce revenue risk. It’s succeeding: the volatility of earnings has been steadily dropping, while creating a monoculture of blockbusters in the process.

DEPT OF RISK AND UNCERTAINTY

Objectively subjective

In quantitative research, scientists have to make a series of decisions about data analysis, which can create widely different outcomes. This is worrying on its own, but it’s also a reminder of the importance of repeating experiments and studies.

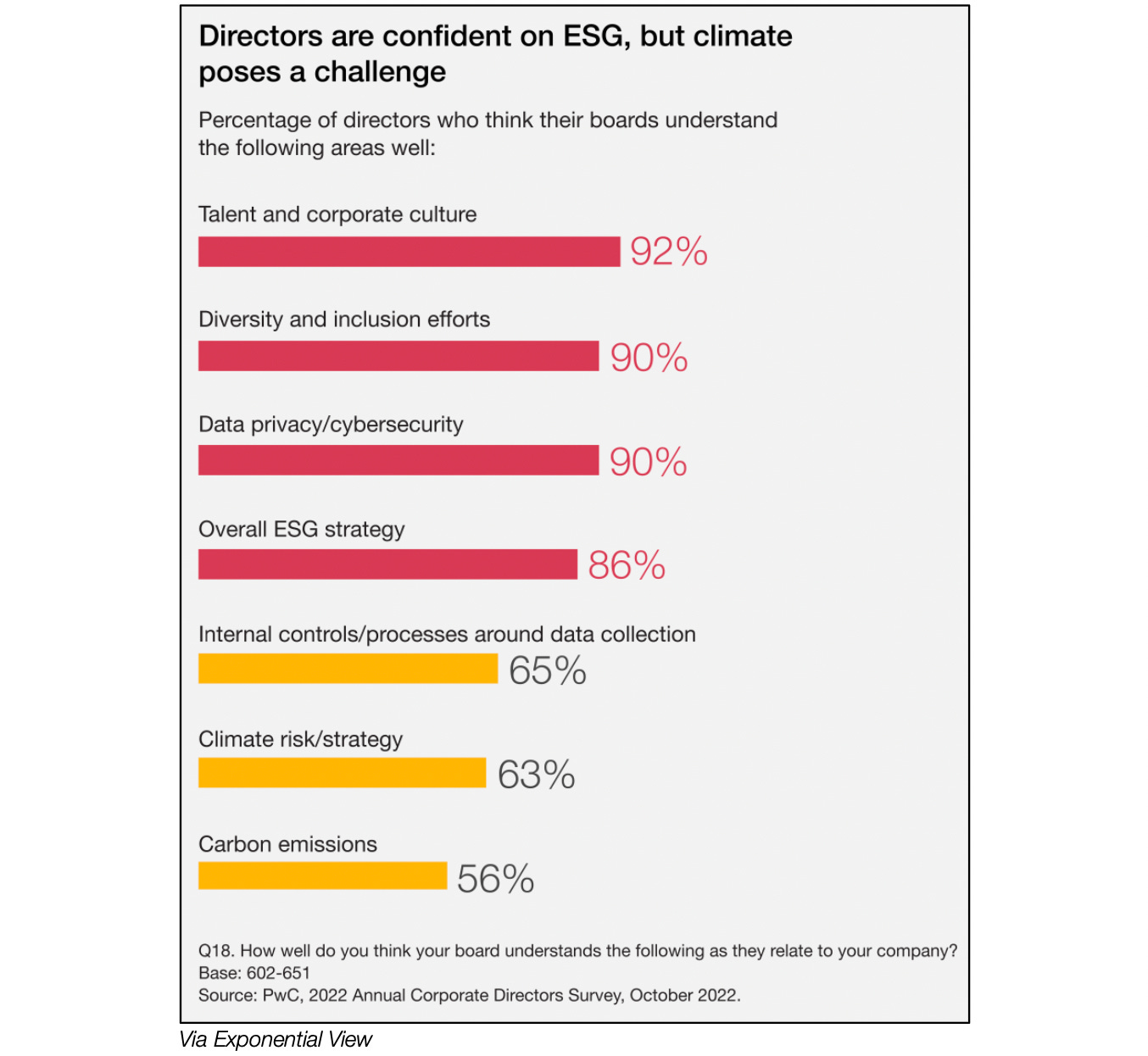

The alphabet of sustainability

It seems like boards tend to understand the S in ESG much better than the E, especially when it comes to carbon emissions. This is hardly surprising: as we develop better tools to understand the climate impact of organisations (e.g., scope 1, 2 and 3 emissions), we also uncover how opaque a company’s emissions can be. It’s similarly tricky to estimate climate risk.

Lowers all boats

When bonds zag, stocks zig, and vice versa. Not so this year. This year is one of the first in a century when stocks and bonds have both fallen, comparable only in scale to the 1931 collapse.

Bloomberg predicts that the UK will likely be the first economy to fall into a slump, with the US leading the way out of the crisis.

Starlink in their eyes

The use of Starlink satellites is increasing in Ukraine, essentially keeping the country - and its military - online. The question remains on who will fund this in the longer term - SpaceX, the US government, or even the EU.

WEEKLY SURVEY

Source: Engadget