🔮 Exponential View #550: Productivity and jobs; the slop-economy; loving vapes++

An insider's view on AI and exponential technologies

The level of deep insight into technological trends and forward-looking info you share is unmatched. No one is doing it like you. – Susan, a paying member

Hi,

Welcome to our Sunday edition, where we explore the latest developments, ideas, and questions shaping the exponential economy.

Enjoy the weekend reading!

AI, jobs and productivity

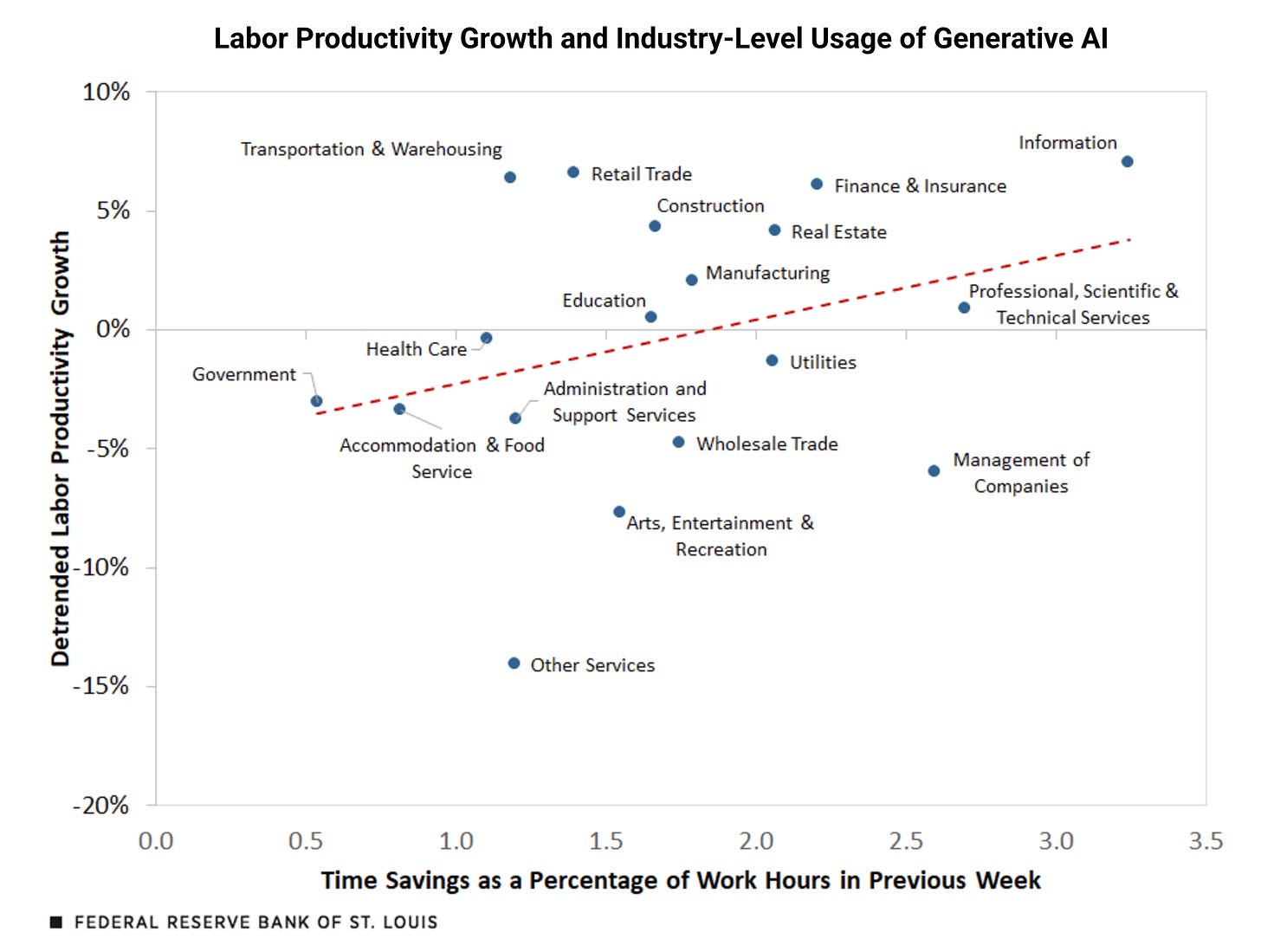

The St. Louis FED estimates that generative AI may have increased labor productivity by up to 1.3% – and has had positive effects on industry-level productivity. While that may sound modest, a sustained 1.3% annual productivity boost would be transformative1.

We’re seeing the micro‑signals of this shift inside firms. A new paper found that AI agents increased code output by 39% without any decline in short-term quality. More telling: for every standard deviation increase in experience, developers accept 6% more agent‑generated code. Senior engineers are simply better at delegation, and delegation is a skill that compounds with time. As AI takes on more execution, the premium – particularly for those entering the workforce – will move from raw output to orchestration.

I dug into this question with Ben Zweig of Revelio Labs, which builds its own data-driven view of the labor market. Ben and I share the view that it’s probably too early to really see AI impact in the early hiring. Ben’s perspective is that softening in early hiring is coming from somewhere else:

there’s a lot of uncertainty in the labor market, partially due to AI, partially due to policy. As a result, employers have a high discount rate. Young workers are the workers that are more uncertain. So, it’s a kind of high-risk, high-reward type of bet, whereas more experienced hires are the safer bets.

And to the million-dollar question for parents of “what should my kid study?”, Ben gave two concrete recommendations, which you’ll find at the end of our conversation.

AI bubble watch – a weekly update

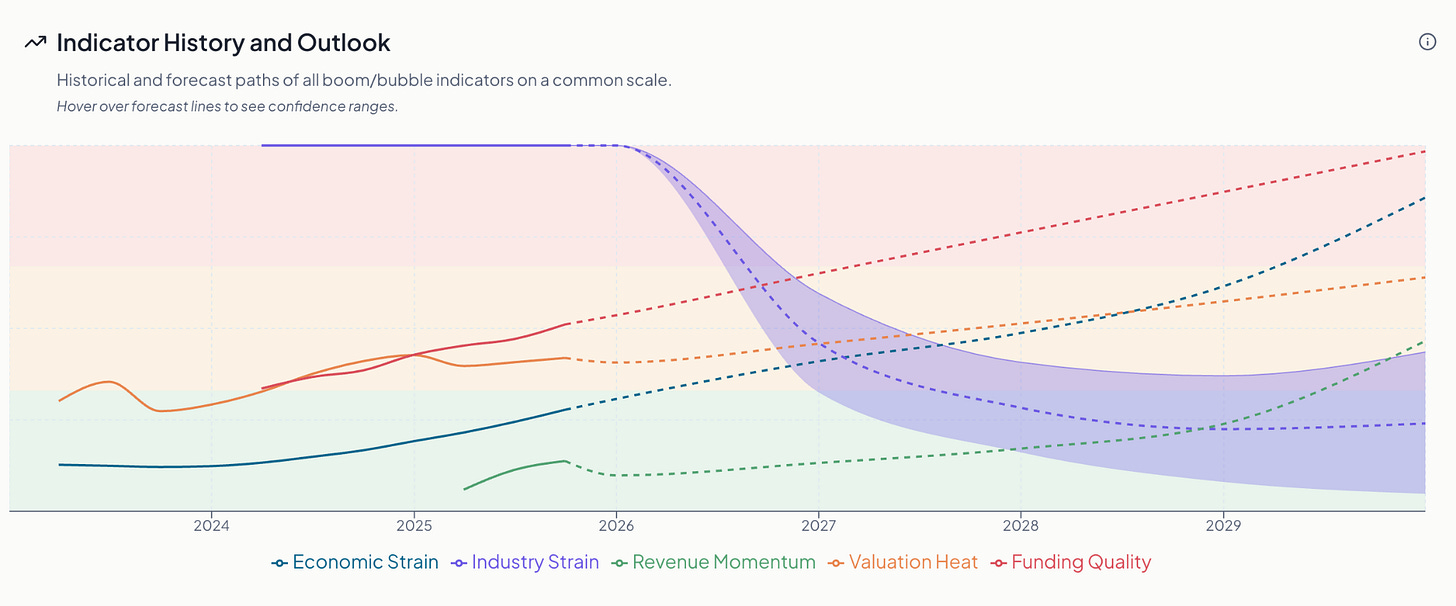

📈 Quick read: AI remains in expansion mode, but funding quality is deteriorating. Details on the week’s movers and dislocations below.

Boom/Bubble dashboard update: We’ve added projected trajectories for each of the five key indicators between now and 2029 – the indicator history and outlook is interactive and you can access it for free on the Boom/Bubble website.

Movers:

CoreWeave cut its 2025 revenue forecast to $5.05–$5.15 billion after delays in building new data centers. Investors did not like that; its shares fell by nearly a quarter. The cost of protecting against a CoreWeave default, measured by a 10‑year CDS, has jumped more than 60% over the last six weeks to 700 basis points. Likewise, Meta signaled AI spending could exceed $100 billion next year; shares fell 12.6%.