🔮 The Sunday edition #510: Gemini market advantage; DeepSeek bans; Faustian bargain; good nukes++

An insider’s view on AI and exponential technologies

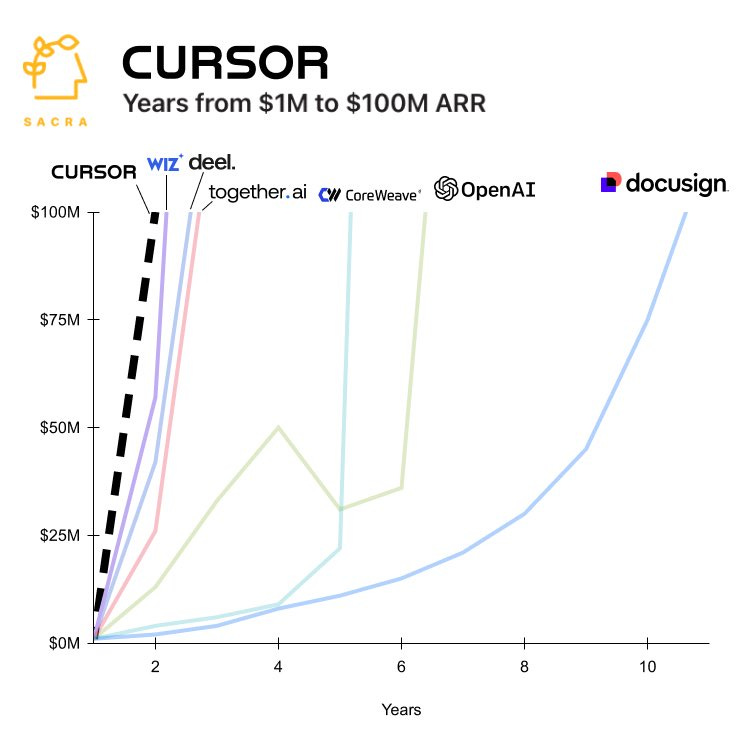

Hi, it’s Azeem. Every week, we aim to capture what goes on amidst simultaneous transformations in markets, technology, and Earth’s climate – this edition is full of paradoxes. A regulation to reduce ship pollution has accidentally accelerated warming. Meanwhile, Cursor, an AI-based development platform, hit $100 million ARR faster than any company in history. When AI can complete tasks at 1/30th the cost of human labor, even Paul Krugman’s tech bubble comparisons might underestimate what’s coming. Let’s explore.

Bay Area friends! I’m heading to San Francisco next week and will be joining NfX’s Pete Flint for an intimate fireside chat on Wednesday, 12 February at 6pm. We’ll be exploring the themes from today’s newsletter and much more. Grab your spot here – spaces are limited.

Paul Krugman’s AI déjà vu

Economist Paul Krugman sees parallels between the late-90s tech bubble and today’s AI frenzy. In my conversation with him last week, he compared the hype around the “Magnificent 7” to the sky-high valuations of 1999-2000. He continued his thinking on the topic in his latest post, suggesting AI will deliver a productivity boost akin to the IT surge of 1995-2005. But, he questions whether that justifies the valuations we’re seeing.

I somewhat agree. On the one hand, at a minimum, I reckon AI will deliver a similar boost to that of computers but it could be higher, and it could come quicker. The IT surge arrived some 13 years after the IBM PC created the market. AI’s impact could come sooner, especially if this survey of research by the Fed, which suggests between 20 and 40% of American workers are exposed to genAI, is correct.

On stock prices: bubbles are largely psychological. The valuations of the Mag7 are a call on long-term American dominance in AI, a confidence shaken up by DeepSeek earlier this week.

With more than $300 billion of capex, propelled by AI, planned this year, Mag7’s investment intentions are more significant than the telecom bubble of the late 1990s. Between 1996 and 2000, roughly $500 billion was ploughed into digging, ducting and cabling the information superhighway. But these phone companies saddled themselves with debt (more than $300 billion of it). Revenue growth in the sector was pathetic, only 7.2% per annum, and the industry retrenched rapidly as the bubble burst.

This isn’t happening with AI. Sales are, not metaphorically, going hyperbolic. One anecdote: Cursor has become the fastest company in history to reach $100 million in ARR. Customers are buying.

Sure, there are implementation hurdles. But the ceiling is high-reaching; more akin to the Industrial Revolution than the early web. If AI truly absorbs whole categories of work, today’s “lofty” valuations might someday look modest.

See also:

Markets are not betting on AGI yet. 30-year US bonds still have low real interest rates (~1.6%). If investors believed in a near-future AI revolution, we’d expect different yields, since they should reflect expectations of future economic growth – so either the market is right, or there’s a potential trillion-dollar opportunity in betting they’re wrong.

Gemini pushes a price war

Google released Gemini 2.0 Flash to the broader public this week, and it is much cheaper than anything on the market of the same quality. Based on data from Artificial Analysis, an independent analysis website of AI models and hosting providers, Gemini 2.0 Flash is currently the cheapest and best non-reasoning model available1.

Pricing is clearly in response to DeepSeek’s very aggressive moves. In fact, Gemini undercuts every comparative provider on the market. At the same time, Google increased the cost of its workspace services, productivity, and collaboration tools suite by about 15-20% and abandoned its former policy of charging for AI as an add-on. This is likely to force adoption – because firms are paying for AI features regardless – and will potentially strengthen ecosystem lock-in.

A common theme is emerging – all models are being commoditised as competition pushes down prices. Value is moving to vertically boundless applications like Google Workspace or Microsoft’s applications. Even OpenAI is emphasising products more and more. Increasingly, differentiation will come from agentic capabilities to justify premium prices.

Faustian bargains

Global temperatures have risen by 0.4°C in just two years, reaching +1.6°C above pre-industrial levels – prompted by one of the periodic tropical El Niño warming events, but double what a weak El Niño pattern would cause. Hansen et al. attribute this acceleration partly to a 2020 shipping regulation that cut sulfur in ship fuel, reducing cooling aerosols. It’s a Faustian bargain: we get immediate benefits from lower air pollution, but we pay for it with a hotter future.