📈 Nvidia-a-a-a-a-a-a

Boom or bubble?

Nvidia burst through the $3 trillion barrier yesterday. The chipmaker’s stock is responsible for a third of the gain in the S&P 500 market this year.

It is worth more than Apple, but looking at fundamentals, it is treated very differently.

Apple has more than 7 times the revenues and about 4 times the profits of Nvidia. Apple of course is not growing. Investors are betting heavily that Nvidia’s revenues will continue to grow.

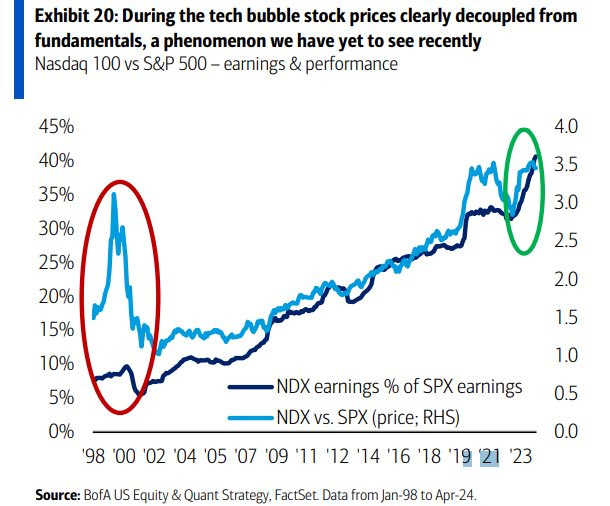

Is this a bubble? Technology markets are prone to exuberance and bubbles. And stock prices can depart from fundamentals. One analysis from BofA, below, suggests that, unlike the dotcom bust, that divergence hasn’t yet happened.

On the other hand, if we go back to the 1840s railway mania in Britain, the equivalent of 5-7% of GDP was invested in the nascent technology annually, much of it wasted.

That 5-7% of GDP today would be roughly $1.1 to 1.5 trillion dollars in the US per annum. In the last 12 months, Nvidia has added $1.2 trillion to its market cap.

Earlier t…