💬 Friday thread: free money

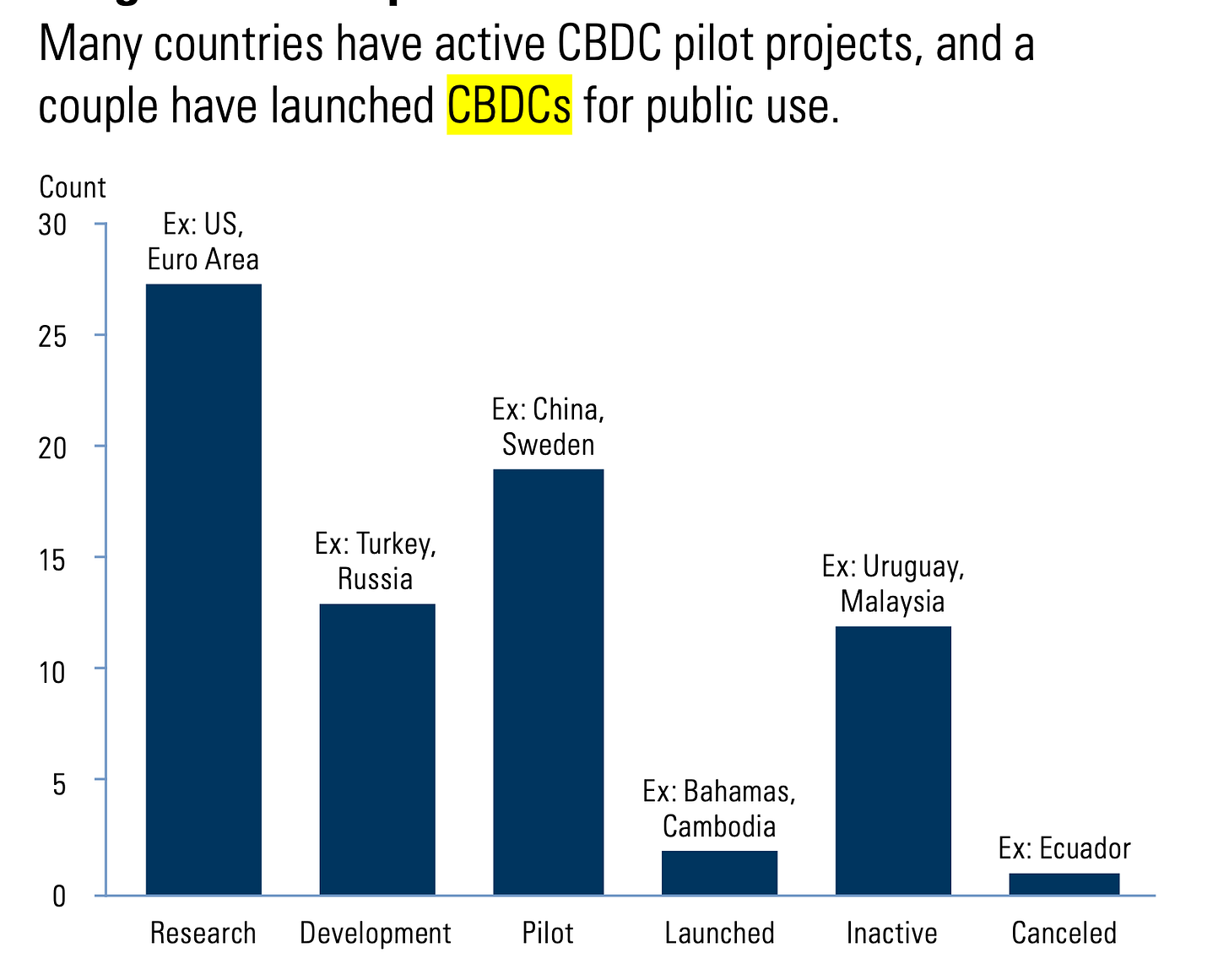

Central bank digital currencies are hot.

🇧🇸 Bahamas: the sand dollar was the first

🇳🇬 The e-naira launches on October 1st - it could help the financial excluded

🇨🇳 China had a material pilot of the e-renminbi, which had programmatic rules about spending.

🇬🇧 UK: “Digital cash could be programmed to spend only on essentials”

🇺🇸 US is preparing a paper on the subject. But it is complicated: There is an established industry that doesn’t largely favour CDBCs. The risks to the dollar's strength and potential new risks loom large.

As the IMF writes:

As national currency, cryptoassets—including Bitcoin—come with substantial risks to macro-financial stability, financial integrity, consumer protection, and the environment. The advantages of their underlying technologies, including the potential for cheaper and more inclusive financial services, should not be overlooked. Governments, however, need to step up to provide these services, and leverage new digital forms of mo…