🔮 Exponential View #542: China rewires power. AI crosses into biology. We answer the $10 trillion question.

Insights for the decade ahead.

Hi all,

Welcome to our Sunday edition – and thank you for reading.

Markets wonder if AI is a bubble, China is executing the largest clean energy build-out in history and AI systems are beginning to design viable virus genomes. Capital, energy, and biology are all being rewired at once.

But before we get stuck into this week’s ideas and developments, I want to share my conversation with Vinod Khosla in which I lay out my vision for the next ten years:

Let’s get started with this week’s briefing on AI and exponential technologies.

Is AI a bubble yet?

The $10 trillion question everyone is asking. To answer it, we built a data-driven framework that compares today’s AI boom with past bubbles. We look at economic strain, valuation heat and the quality of funding driving the frenzy, plus two other gauges to tell where AI stands.

You can pair our analysis this week with veteran VC Jerry Neumann’s insightful essay that frames AI as a late-wave innovation entering its maturity phase – one that’s unlikely to make you rich. He compares AI to containerization where competition and high capex costs squeezed the margins and growth opportunities:

Shipping containerization was a late-wave innovation that changed the world, kicked off our modern era of globalization, resulted in profound changes to society and the economy and contributed to rapid growth in well-being. But there were, perhaps, only one or two people who made real money investing in it. […] McLean did, as did shipping magnate Daniel Ludwig, who had invested $8.5 million in SeaLand’s predecessor, McLean Industries, at $8.50 per share in 1965 and sold in 1969 for $50 per share.

Jerry expects most of the gains of AI to accrue to consumers and downstream companies: cheaper healthcare, education and professional services, just as containerization cut costs for companies like IKEA and Walmart rather than enriching the shipping industry itself.

But I do see at least one important difference. Containerization spread across a fragmented network of ports, terminals and shipping lines – no single actor held sway. Digital markets, by contrast, concentrate control. A small cohort of firms can dominate users, data, compute and monetization. OpenAI, with 700 million users, controls its entire network and can turn it into a self-reinforcing, data-driven flywheel. Where containerization spread value thinly, AI platforms can concentrate it. That doesn’t mean fortunes will flow freely, but it does mean incumbents might extract more than Jerry suggests.

Resetting the transition

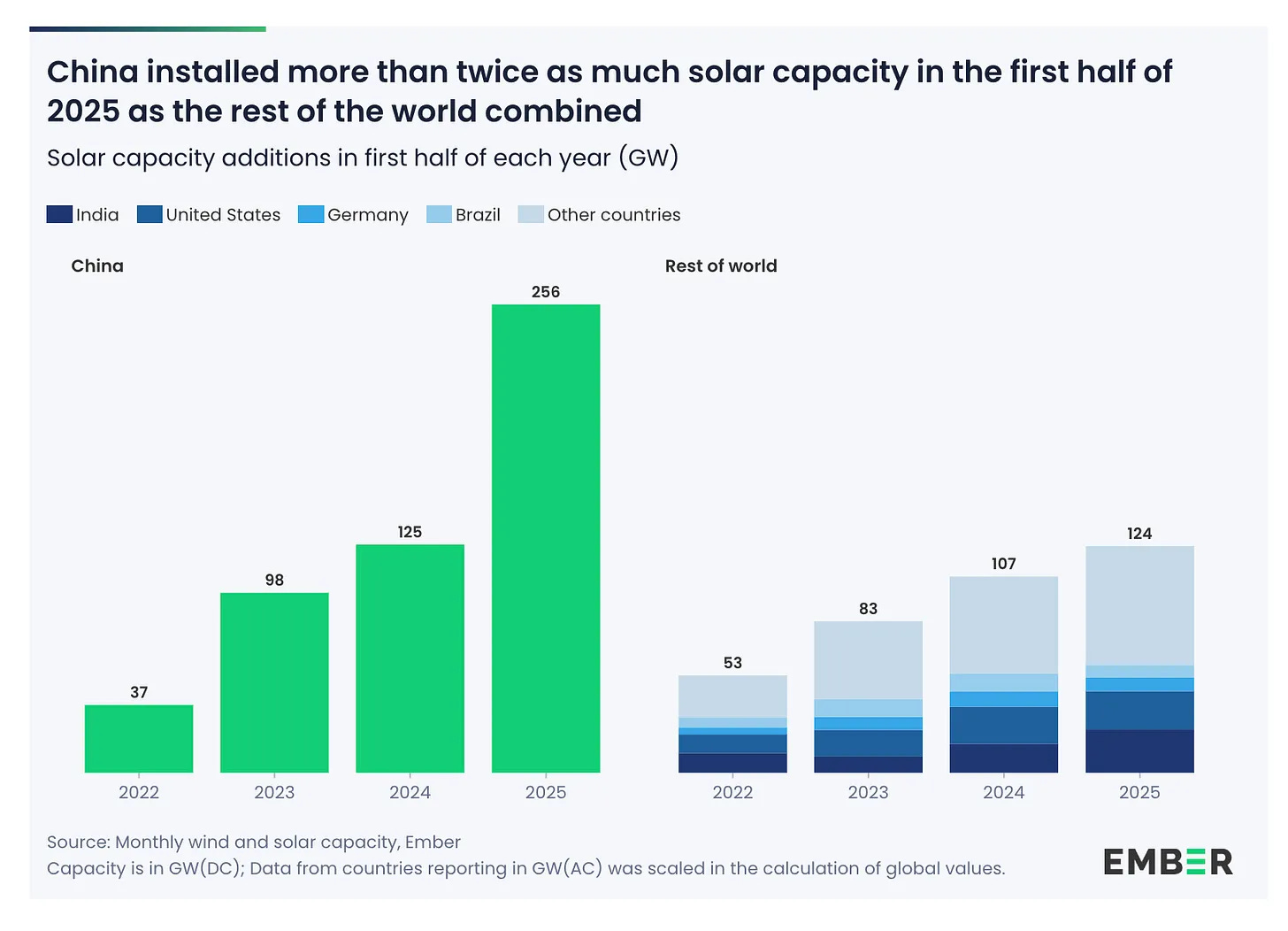

China is executing the largest clean energy build-out in history. In the first half of 2025, global solar installations grew 64% and China alone accounted for two-thirds of that growth. With costs down 60-90% since 2010, China’s solar and wind now generate more power than hydropower, nuclear and bioenergy combined.

The West has a lot to learn. As I mentioned yesterday, we’re living through a value inversion:

Frankly, it’s a bit odd when abundance creates crisis and scarcity drives prosperity. Perhaps our fundamental economic grammar – that language of supply, demand, and equilibrium we’ve trusted since Adam Smith – is out of date. […] We subsidize scarcity (fossil fuels) while penalizing abundance (renewable oversupply). Scarcity thinking is colliding with abundance reality.

EV member Michael Liebreich argues that Western climate policy has been captured by impossible expectations and purity tests.