🔮Sunday edition #526: Did China just break America’s chip stranglehold?

Jensen Huang admits defeat: China's $50B AI market is now "effectively closed" to US vendors.

Hi, it’s Azeem. This week, we’re seeing AI systems quietly achieve new levels of self-improvement, a subtle yet profound advance. Simultaneously, the global semiconductor map continues to be redrawn, with significant developments in China’s push for homegrown silicon. The practical consequences of these shifts are already tangible – from coding to workplace autonomy to war.

You’re in exactly the right place to understand what comes next. Let’s go!

Homegrown advantage

China is breaking through chip controls. The country’s tech leaders have narrowed the gap in areas of AI hardware, notably around inference and by some accounts may only be a single development quarter behind the United States with a remaining holdup being software, not silicon. Alibaba, Tencent and Baidu say rewriting their large-model pipelines from Nvidia’s CUDA platform to Huawei’s CANN toolkit will delay new AI development by about three months, not years. After this, day-to-day AI workloads can run on homegrown chips instead of imported Nvidia parts. Huawei is laying that foundation with the Ascend AI processor. Domestic chipmaker, AMEC, is ramping up its local production. In practice, the companies will keep training on their dwindling Nvidia inventory, where US technology maintains a reliable lead, while shifting the fast-growing inference workload to Ascend processors and other local silicon.

Jensen Huang says China’s $50 billion AI-chip market is now “effectively closed” to American vendors.

China is developing a new Made in China plan to focus on home-made high-end technological goods.

Intrinsic motivation

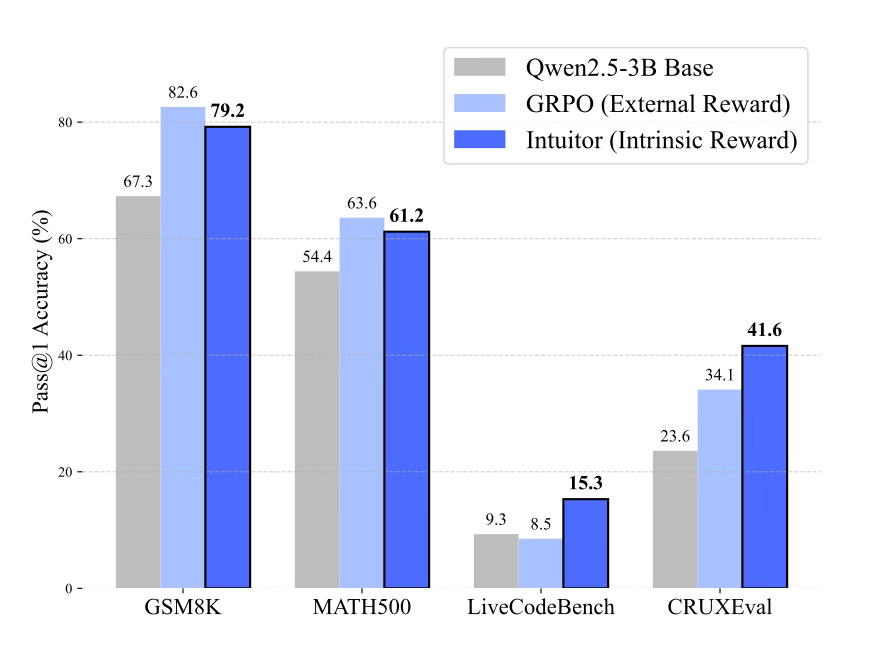

AI models can now learn to reason better by simply trusting their own confidence –no human feedback or gold-standard answers required. A new study out this week introduced a method called Intuitor that rewards outputs the model feels most confident about, creating a self-reinforcing loop that encourages elaborate, structured thinking. The new method made it better at learning how to learn; the AI was only trained on math problems, yet the one that learned to trust its own judgment became significantly better at coding too.

Alongside this, a companion study shows an LLM inventing and iterating on its own algorithms and outperforming the best human-designed techniques on benchmarks. It transferred those gains to entirely new model combinations which is evidence of AI refining the very tools of its self-improvement.

These are two of several recent papers that show a path to self-improvement – there’s a clear pathway from here. This could offer powerful new capabilities but also require vigilance against unintended behaviors like reward hacking.

A VC reboot for Europe

The VC playbook – sprinkle dollars on lean software start-ups and let network effects do the compounding – no longer matches the geopolitical chessboard.

As John Thornhill notes, the cost curve has flipped: genAI breakthroughs depend on expensive data-centre build-outs and chip supply chains, so Big Tech and state-backed pools of capital (think Saudi Arabia’s $40 billion AI fund) are out-muscling traditional VCs. The median founding year of the companies that anchor Europe’s main equity index is 1892, versus 1946 in the US – a 54-year innovation deficit that exposes how rarely the continent refreshes its industrial leaders.