🔮 Too much exponential?; AI scientists; digital simulacra; moving stones and forging people ++ #487

An insider’s guide to AI and exponential technologies

This is a free edition of Exponential View.

Each week I take a critical look at exponential technologies and their impact on the world. For more upgrade to access full edition

🔥 This year, I’ve spoken at thirty or so corporate events, investor conferences, leadership offsites, and board meetings. I’ve helped decision-makers across industries figure out what to do over the next few years. GenAI has been, of course, one of the hottest topics I’ve talked about.

⏰ I have limited availability in Q4 for your board meeting or flagship event, so please contact me ASAP.

Ideas of the week

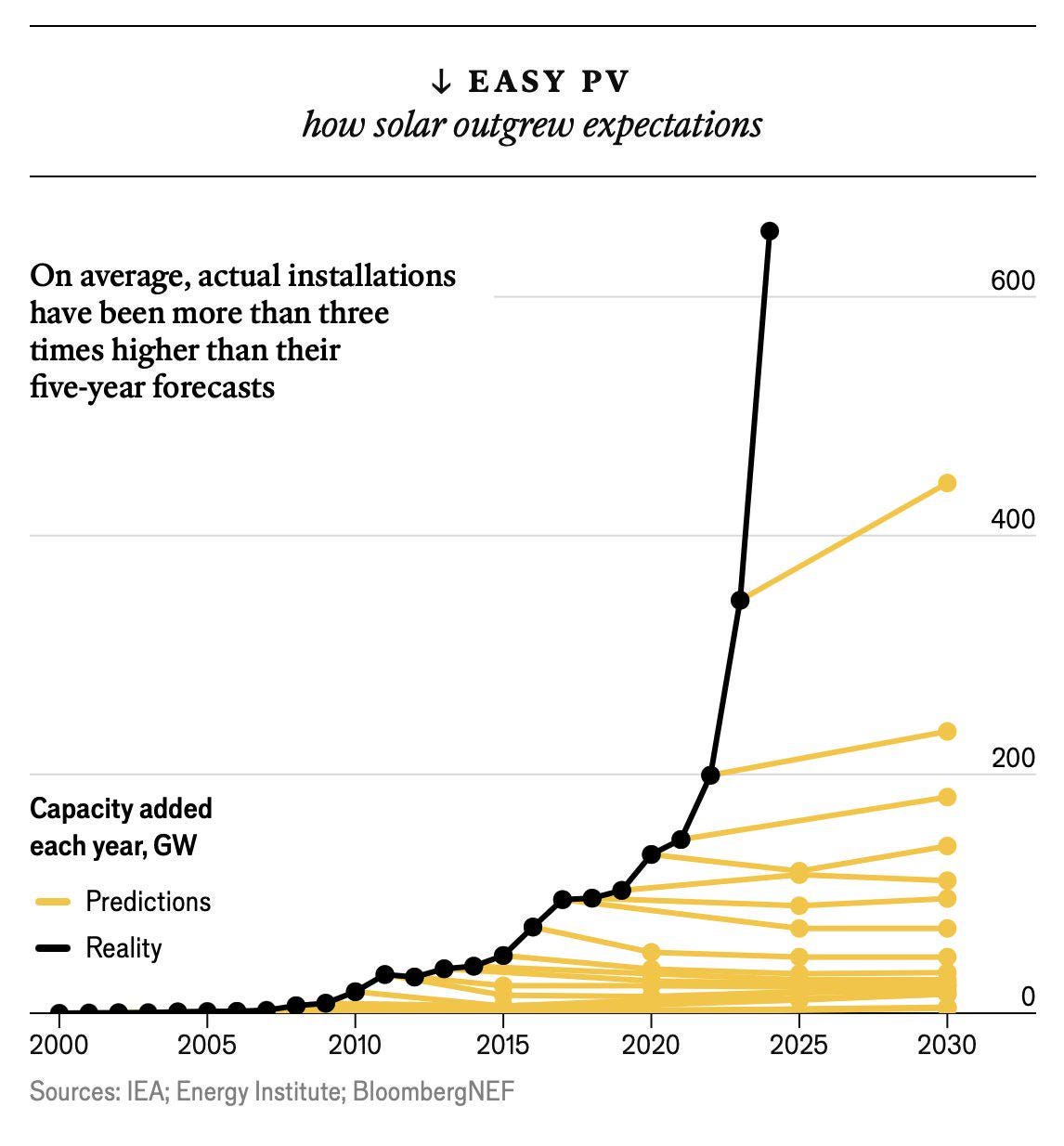

China loves making things. This past decade, China zeroed in on strategic industries such as EVs and solar – exponential technologies, as we all know. However, there could be a problem: these industries produce more than global demand. The result is negative margins for many industries, as Trina Chen from Goldman Sachs explains in this short, nuanced interview (part two here).

However, China’s pain could be the world’s gain. As its companies dump their products on the markets, the result may be a faster adoption of green technologies that are good for consumers and the planet (see what happened in Pakistan, as a great example).

To appreciate what is happening, nudge aside economic orthodoxy for exponential thinking. Approximately 30% of China’s industrial enterprises – around 150,000 companies – are operating at a loss.

The country’s domestic demand for manufactured goods is insufficient, just as the US, EU and India have slapped tariffs to protect their own industries, shrinking the market for Chinese products. Goldman Sachs estimates that in five of seven key sectors, Chinese capacity exceeds global demand. For solar Chinese capacity is twice the demand; for lithium it’s 50% higher.

As a result, key Chinese product prices have plummeted over the past two years.

Conventional wisdom decries Chinese clean tech overcapacity, but this view is shortsighted. China's overproduction has slashed costs, accelerating global renewable adoption. While supply currently outstrips demand, climate urgency needs imminent exponential growth. The challenge: effectively managing the transition period until demand catches up.

That interim period, where manufacturers must survive to maintain production, is critical. Goldman Sachs expects the solar and lithium market to reach balance this year or next, but predicts that China may face bigger difficulties with their EV and power semiconductor industries. In sectors driven by Wrightian learning curves, history tells us that even if cyclicality results in boom and bust, it is often a short-term blip that barely registers on a long-term trend. The semiconductor industry is the best example – between 2001 and 2022, annual sales grew 313% despite supply and demand imbalances. Will history repeat for these key climate change technologies?

The rest of today’s edition is open to paying members. Here I cover:

Ideas:

What do we need for LLMs to automate research?

Can AI models forecast human behaviour?

This company wants to make the next generation of search fairer

Data

The GenAI funding divide

The best way to communicate climate change

Carbon’s debt premium

Morsels

What ages are the key milestones for health?

The Stonehenge mystery solved

Air pollution’s changes to gene expression

and more signals to unpack this week!

Preview

This is a preview of yesterday’s Saturday column. This went viral on X with hundreds of shares and likes.

🧐 Eric Schmidt’s AI prophecy: The next two years will shock you

Could AI help you build a competitor to beat TikTok in just a few minutes? Maybe in the next couple of years, according to Eric Schmidt, Google’s former CEO. My buddy Erik Brynjolfsson invited Schmidt for an intimate discussion at Erik’s Stanford Econ class a few days ago.