💡 Our world in flow change

Our systems are being violently shaken into change

It’s Azeem. Every few weeks, I invite an expert EV reader to share their thesis with us. This week, we’re looking at a topic which is close to my heart: how we build well-balanced systems. As world’s economic system grinds to a halt, understanding this is important.

A regular Sunday wondermissive also went to paying members today. To receive it every Sunday, access our live briefing calls, and Friday community discussions, become a member. 35% of each annual membership goes to funds fighting Covid-19 worldwide.

This week, my buddy David Galbraith, has agreed to step in to address this. David and I have known each for more than two decades, and I had the opportunity of working with him for a couple of years. He has quite a unique mind and is a big picture thinker.

This is a two-part special. Part 2 will appear in members’ inboxes tomorrow. I’ve touched on a number of these themes before, including in a podcast discussion with Carlota Perez. I’d encourage you to listen to it, here or wherever you get podcasts.

Please take a moment to thank David—or raise questions in the comments.

See important disclosures at the end of this email.

Flow Change

I am David Galbraith.

I am a designer who gathers insights and synthesizes new investment theses, or designs business models and product ideas around them, at Anthemis.

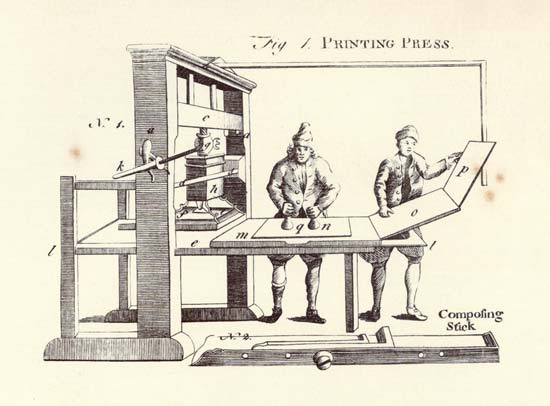

To do this, I approach things through the lens of systems design and flows. It is from this viewpoint that I’ve looked at how the invention of the Internet fundamentally changed information flows, while the resurgence of China is doing the same for trade and capital. The last time this happened was five-hundred years ago with the invention of the printing press and discovery of the New World, where it led to large-scale innovation, fundamentally new types of organization, and a long period of backlash.

From this viewpoint, I’ll suggest that the change we are seeing now is not just another phase of industrial revolution. We are witnessing something as profound as the shift from agricultural to industrial society; we are seeing the backlash, first to the internet, and now to trade and globalization.

Business design provides a good toolkit to look at these macro changes from a systems perspective. Unlike things such as buildings (my former profession) or most product design, businesses are open systems with input and output flows of physical resources, people, information, energy and capital. They have the equivalent of metabolic cycles, and are more akin to living things, while the connections between them are more like living ecosystems.

At, Anthemis, the investment firms where I work, we developed a systems language for looking at business design, as you can see below:

A system is any more or less complex mechanism with a boundary with gaps in it for inputs and outputs. Unlike the design of a mechanism such as a watch, systems design involves looking at the flows in, out and between systems, individually and in groups, and most importantly balancing the trade-offs between the opposing forces of action and reaction, as a result of changes to these flows.

A river sits on flows which change over time

Well-balanced systems are tuned between efficiency of flows in an existing environment, and resilience via adaptability to a changing one. The flows between global systems (countries, institutions, cities, supply chains, businesses) were in the process of rerouting to a new stable configuration as the hierarchical, industrial age is being replaced by the networked, digital one.

Then the Coronavirus pandemic hit, and now they are being violently shaken into it.

Before I worked in finance, I was an Internet entrepreneur, and before that I was an architect. There is a common purpose in all three activities. The purpose of architecture is to create shelter to mitigate the effects of weather and other environmental conditions. In a nod to tuned systems and Bach’s Well Tempered Clavier, its purpose was summed up by the architectural historian, Reyner Banham as “The Architecture of the Well-tempered Environment”.

Well-tempered systems of business and trade require balance between efficiency and flexibility; progressive but moderate politics requires rewarding industriousness and innovation and protecting against misfortune for growth that minimised inequality. Every change in any system is accompanied by an opposing reaction. This understanding of the balance between them is what produces healthy ecosystems. This, for me, is the best lens to look at both secular changes that were already under way before the pandemic hit, and what the effects might be subsequently.

Current shifts are more significant than we might think

Current secular shifts are the result of transformational changes to flows of trade and capital (due to globalization and the reemergence of China), and information (due to the Internet). I believe this is not just another phase of the industrial revolution as some historians have suggested, but a change as significant as the pivot from agrarian to industrial. The best parallel to what might lie ahead is the pre-Reformation (printing press and the New World) and to some extent, the ways the Plague set the stage for the urbanisation and technological progress by reducing labor supply and increasing wages. More on these parallels in Part 2.

In 1665, working from home to escape a pandemic, Newton first began thinking about gravity and what would later become his laws of motion, including the third law, which states that “for every action there is an equal and opposite reaction”. We are now seeing reactions to the initial benefits of a more virtually and physically connected world. The initial utopian, counterculture dream of the connected world of the Internet has been more recently replaced by privacy concerns, fake news and manufactured consent.

In addition to the dystopian counter-reaction to virtual flows of information, we now have the reaction to a more physically connected, globalized world — a pandemic disease. Just as historical disease like the Plague followed the Silk Road trade routes from China, Coronavirus happens to have spread from China, eastwards, via modern outposts on the modern Silk Road, or the Belt and Road Initiative. While in 2008 massive injections of stimulus were provided to stop financial flows from stopping, this time it’s physical. Flows of physical things, from people to goods, and from supply chains to tourism, have stopped and the stimulus is to tide us over until we can restart them. But when we do, the landscape will have changed.

A massive shock to the global economy will cause immense suffering and economic misery. Paradoxically, it will not set things back, but accelerate changes. The Plague led to rising wages and the emancipation of feudal peasants, urbanisation and the shift of global power from China to Europe; the two World Wars led to the modern welfare state, women entering the workforce, and a shift of global power from Europe to the US; current events will result in similar changes across the board. A small example of current accelerated changes might be the acceptance of telemedicine via video conference by regulators and consumers alike; a larger one would be a new social pact and universal basic income (which may be arriving in Spain), and an even larger one would be a cementing of the shift from the US to Chinese global hegemony.

Rebalancing from efficiency to flexibility

In Scale, Geoffrey West showed that cities last longer than corporations, because they crop up naturally in places that facilitate existing flows of information and ideas, and adapt to changes of these flows. Historically, cities flourished on very tangible flows of rivers. Nowadays, they flourish on abstract flows of ideas and capital.

West showed that cities outperform corporations because they are diverse, heterogenous and have enough weirdos and contrarians to be adaptable. This can be messy and inefficient in the short term, but in the long run, it is more sustainable as it allows for adaptation to a new environment or ecosystem. This ecosystem view is why modern portfolio theory works in investment and why, when there is a shock like a pandemic, paradoxically, businesses that look to cut back and optimise will fail, as they need to invest to traverse to a new local maximum in a changed fitness landscape. It is why investment in innovation is now more crucial than before. (Azeem discusses the limits of efficiency here.)

The presence of weirdos and misfits was what triggered the rise of Silicon Valley

At a fundamental, information theory level, the weirdos in a city are like noise in a channel. In a Darwinian, Natural Selection model, they are mutations. Without the inefficiency of noise or the disruptive change of mutation, there is nothing to jiggle things into a new place in the fitness landscape, and no natural evolution or adaptation as selective processes operate on them. In absence of this random disturbance approach, we would require the equivalent of Intelligent Design; to be successful that would require perfect knowledge and forecasting of the future of complex systems.

We clearly don’t have that, as recent events have shown, so we need the noise and the creative disruption which will accelerate changes that were already happening and the redundancy that will allow for more flexible trade, and supply chains that are more resilient to shock. There will be a rebalancing away from efficiency to flexibility.

In the second part of this two-part series, I will look at six scenarios based on flows that will dominate our post-Covid-19 world.

David.

Azeem here.

Don’t forget to thank David.

I have covered a number of similar issues in my podcast discussions with Carlota Perez, W. Brian Arthur and Cesar Hidalgo. Full podcast is available here.

I am an investor in a fund run by Anthemis Group, where David Galbraith works, although it does not represent a material portion of my assets.

Cheers,

Azeem