📊 EV’s charts of the week #6 β

Tech startups flying; Belt-and-Road tightening; viral water & water coolers

Hi,

Thanks for the amazing feedback on last week’s chart drop. We’re experimenting with length and breadth. Slightly more to read this week. Comments are open for you to discuss with other members, building on the success of our Friday discussions. Would you like to see these charts follow specific themes each week or should we keep the style the same as previous editions?

Azeem

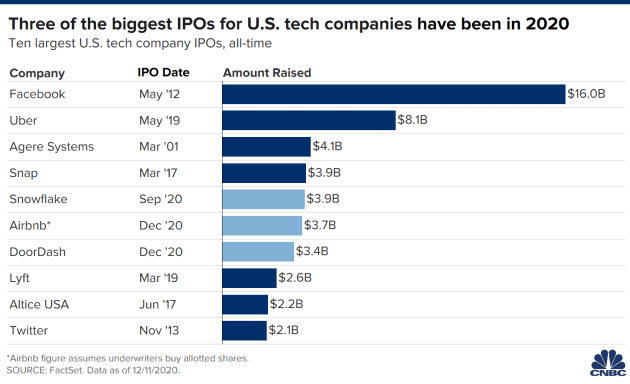

A celebratory week for tech startups

Three of the largest tech IPOs in history took place in 2020, two alone last week. Via CNBC