📊 EV’s Charts of the Week #66

Hi, I’m Azeem Azhar. I convene Exponential View to help us understand how our societies and political economy will change under the force of rapidly accelerating technologies.

🙏🏻 Today’s edition focuses on the Russian invasion of Ukraine. In previous weeks I wrote about the geopolitical implications of the war, and assessed the trends this invasion is accelerating. Consider reading these in parallel to today’s Charts.

When the Pieces Land [Mar 4, 2022]

The Exponential Age’s Maidan Moment [Feb 27, 2022]

DEPT OF RAMIFICATIONS OF THE RUSSIAN WAR

До свидания лето

The EU has been reducing its import dependence with Russia for the past decade. Energy imports are down 33% by value, food and drink imports down two thirds. Source: Eurostat

Will China feel the pinch?

While energy prices are rising in China, consumers are largely shielded from the price rises. China’s commitment to resilient, clean energy continues unabated. Nuclear plant production has increased 400% since 2011 with 46 plants under construction. Sources: Pantheon Macroconomics; Bloomberg

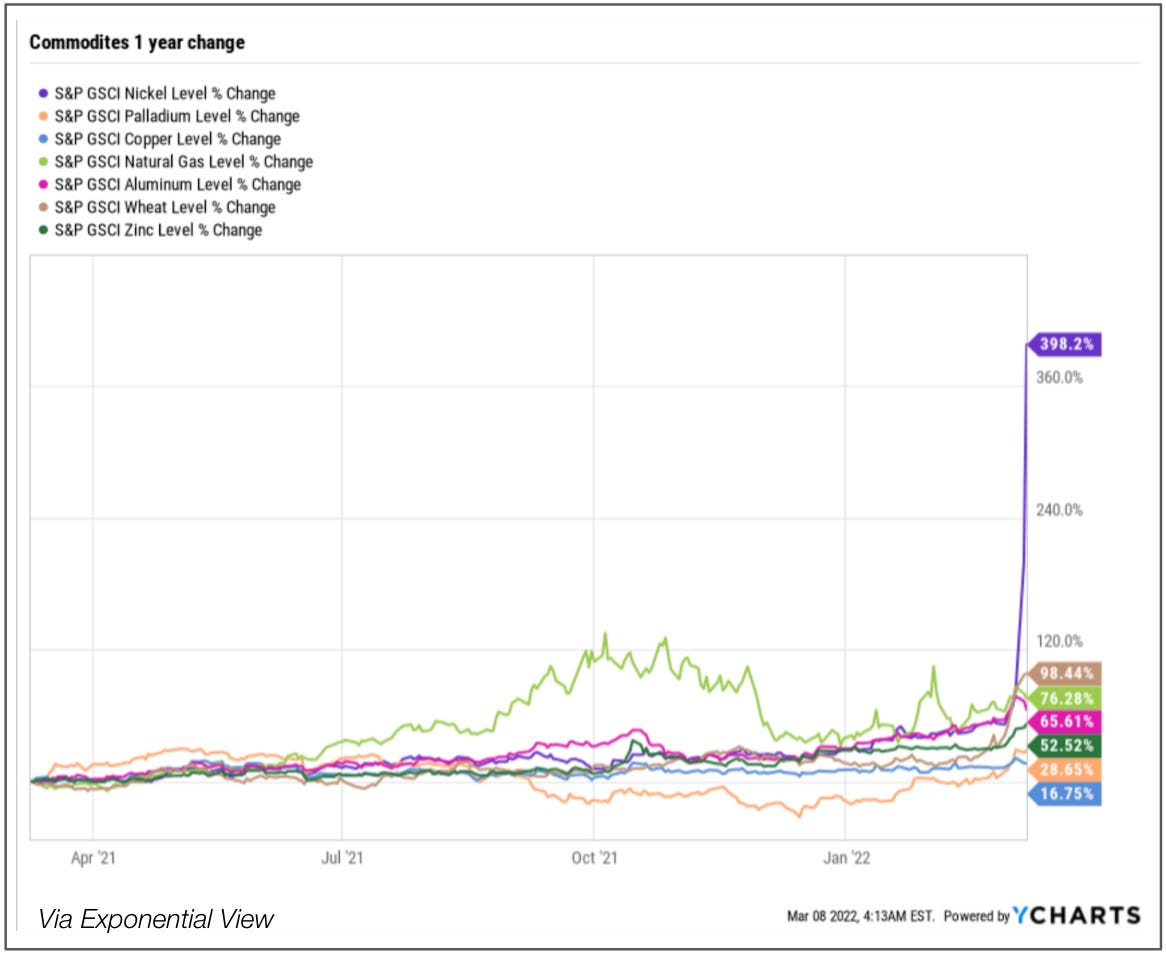

The Nickel rush of 2022

Commodities have spiked over the past year. Watch nickel, where the S&P GSCI index has leapt nearly 400% on the year. This has been driven by a short squeeze, in dollar terms the price of nickel at commodities exchanges is approach $100,000 per ton, up from $25,000-ish a month ago. Source: YCharts

It’s time to build

The coming decoupling is showing up in tech manufacturing investments in the US. Source: SoberLook

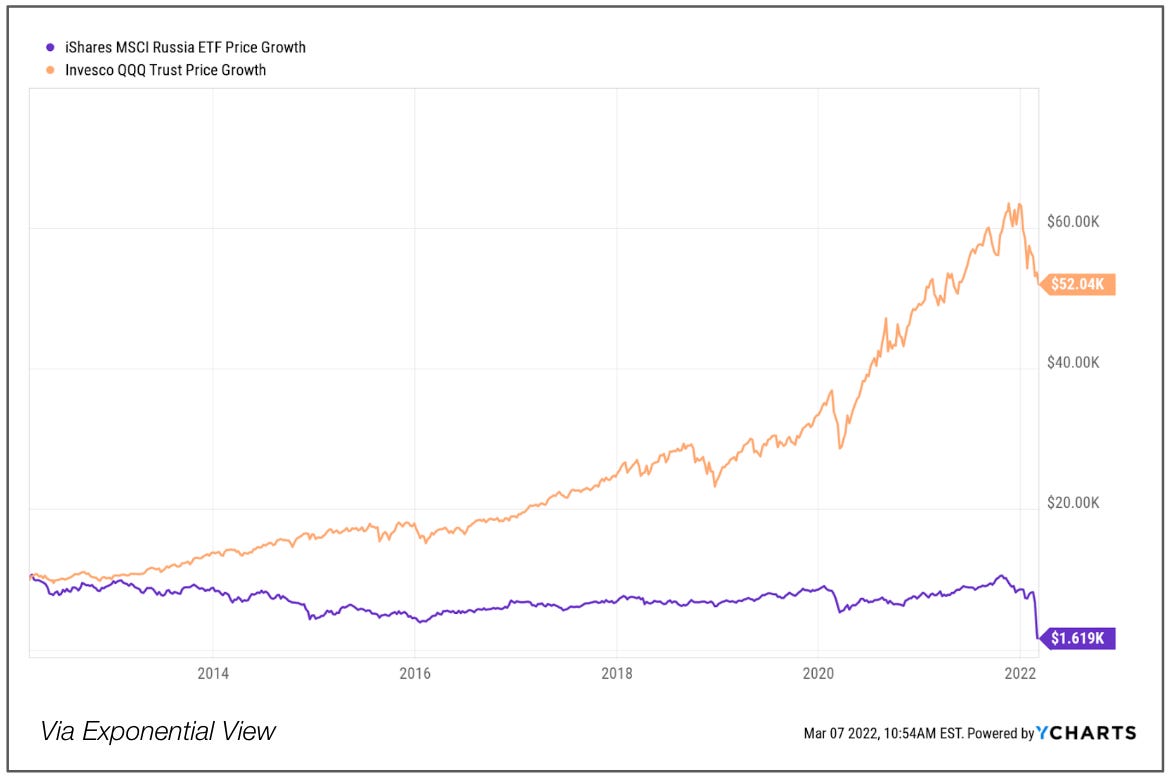

Bearing down

Over the past decade, the Russian stock market has hugely underperformed. Prior to the recent collapse, it was down about 20%. Since the Putinvasion, it has fallen further. If you had played it long and put $10,000 into Russia a decade ago, you’d have $1.6k worth of equities. Had you backed the Nasdaq’s key tech stocks (via the QQQ ETF) your investment would have grown to $52k, despite the sector rotation we’ve seen at the start of the year. It seems like innovation pays more handsomely than extractive industry. Source: YCharts