📊 🎄EV’s Charts of the Week #57

Hi, I’m Azeem Azhar. I convene Exponential View to help us understand how our societies and political economy will change under the force of rapidly accelerating technologies.

This is a best-of edition of Charts of the Week covering the most interesting & important charts of 2021.

You are welcome to forward this email to your friends and colleagues or consider gifting a subscription to Exponential View.

DEPARTMENT OF SHORTAGES

Too big to ignore

As we come to the end of 2021, we thought it would be nice to recap the year in charts by focusing on two of the most important stories we have followed: shortages and the rise of international VC funding. We kick things off with this chart demonstrating how the US Federal Reserve can’t ignore the shortage crisis. Via Bloomberg

An up and down year for energy markets

European gas prices went through the roof in 2021 due to various manufactured and natural shortages, leaving many industrial users little choice but to shut factories. (And domestic energy bills go through the roof.) Via Trading Economics

The transition to renewable energy

The lion’s share of India’s electricity comes from 135 coal-burning power stations. Remarkably they are running with less than a three-day fuel supply thanks to endemic shortages caused by a surge in Chinese demand. It’s not just Europe facing a severe energy crunch. Via The Economist

The one item everyone needed in 2021

Computer chips were one of the most glaring items in shortage this year. Taiwan’s TSMC’s incredible dominance in the chip space comes into sharp perspective in this chart. Incredible. Via FT

A shortage of innovation?

Martin Wolf argued in the FT that the UK has an innovation problem. Finding areas to improve on isn’t difficult. Consider R&D spending. Via Dan Wang

The human shortage

In the era of shortage, China’s birth rate has fallen to lows not seen since 1961. Will the government’s change on the number of children families are allowed to have change the direction of this chart? Via Bloomberg

Who can forget the Ever Given?

“Granpa, what really caused the great resource crisis of 2021? Well, junior, this really big ship got stuck trying to turn around in a canal.” If there was one symbol of the great shortage of 2021, this was it. Via Kess van der Leun

DEPARTMENT OF FUNDING

A big year

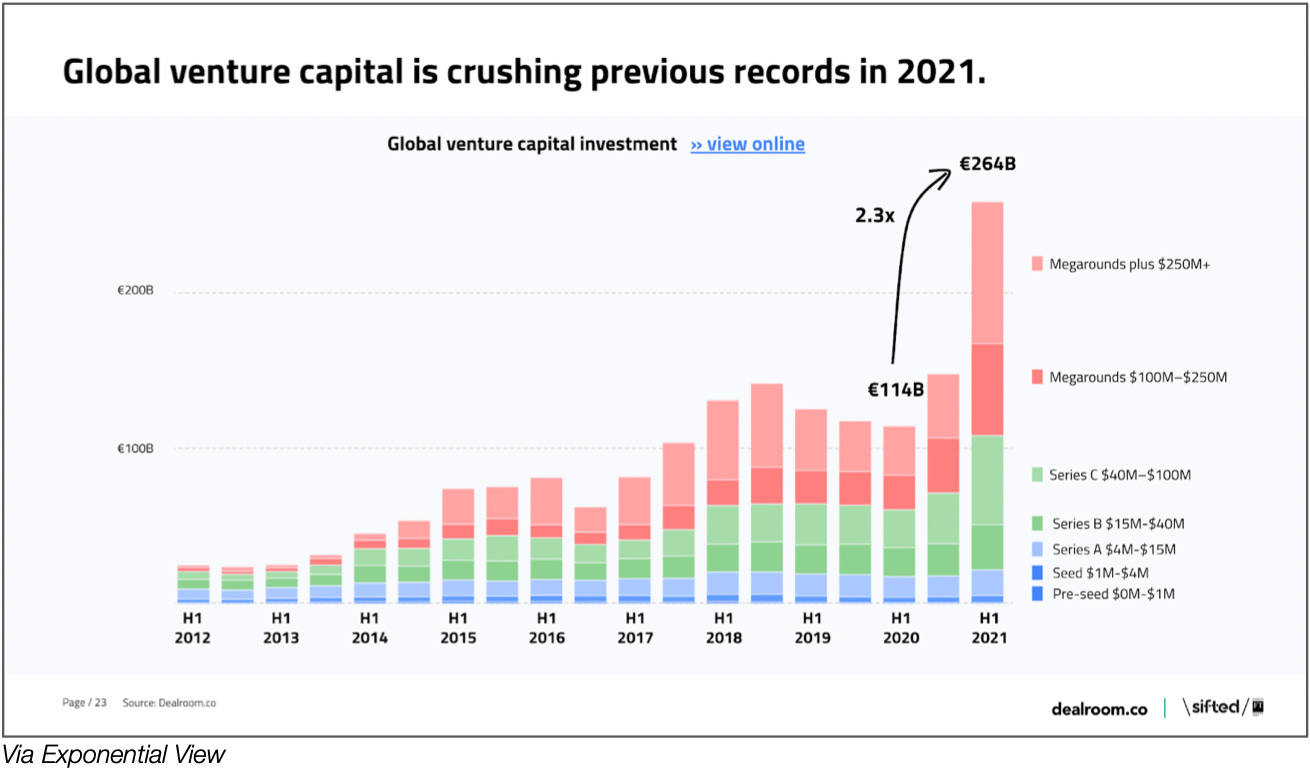

The numbers for global venture capital in 2021 were off the charts. Simply staggering. Via Dealroom

The globalisation of VC

US share of global venture deals fell in 2021. About half of all venture deals are now outside of the US, up from about a quarter ten years ago. Via Dealroom

Europe rises

European seed funding had a big year. At $1.3bn, seed funding is at the highest amount recorded for a single quarter for European startups. Via Crunchbase

The year of the SPAC

IPO capital raised by US SPACs in 2013: $1bn. In 2020: $83bn. In 2021, year to date: $97bn. Via Charlie Bilello / Exponential View

Funds got bigger

As public markets boom and yields trend to zero, capital is flowing into mega VC funds in order to access the technology premium. Capital flowing into large VC funds is around four times higher than about a decade ago. Via Yuliya Chernova

Delivery companies had another banner year

You don’t need me to tell you that the last year has been a boon for food delivery companies. Yet, look at the growth of DoorDash. The company went from 5 per cent market share to over 50 per cent in less than 18 months. Via Tanay Jaipuria

ENDNOTE

No “and finally” this week as our team slows down for the holiday season. Charts of the week will return in the New Year. As always, please feel free to comment and discuss all the charts (and the year that was!).

In the meantime, we’re looking to connect with members thinking about (a) the future of work, and (b) the metaverse, or both. If this is you, fill out this quick form.

Cheers,

Azeem

How happy are you with today's Charts of the Week?

Unhappy | Meh | It's good | Great | Extremely happy, will forward